Monthly Review - September 2024

In brief

The markets

2.0%

0.1%

-0.7%

0.9%

2.2%

4.2%

-1.7%

2.8%

-2.5%

Source: Bloomberg 30.09.2024, returns in local currency

Top stories

A bumper rate cut

The US Fed lowered its benchmark rate by 50 basis points (bps). The scale of the move surprised some, but Fed chair Jay Powell dispelled recession fears, saying the US economy is in “a good place”. Markets responded positively to the Fed’s move, which should ease the path to an economic soft landing. Fed projections indicate another 50 bps of cuts this year, with a further 100 bps by the end of 2025. Elsewhere, the European Central Bank also cut rates, while in China short term rates were cut as part of a broader stimulus package.

More AI funding needed

OpenAI, the founder of ChatGPT, is seeking fresh funds. The target raise is $5 billion, boosting OpenAI’s total value to $150 bn. It was $86 billion at the start of the year. The new valuation would make OpenAI one of the most highly valued start-ups of all time, just behind Elon Musk’s SpaceX. In a demonstration of faith in ChatGPT’s future, backers will likely include Apple, Nvidia and Microsoft, three of the biggest companies in the world. Although OpenAI’s revenues are thought to have hit $2 billion earlier this year, profits are not yet forthcoming, leaving some wondering when the generative AI payback will come.

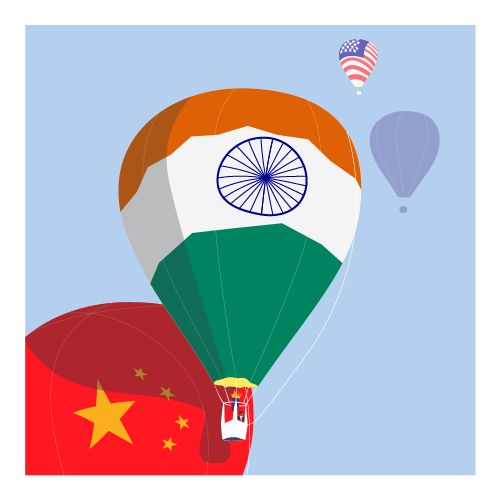

India floats higher

India has overtaken China in the MSCI ACWI*. This equity index tracks the free floating shares of 85% of global companies, hence its nickname the ‘investable’ MSCI ACWI. India’s move into 6th position, at 2.33% of the index, has been boosted by share sales and rising liquidity. Needless to say, with its heavy weighting in technology megacaps, the US dominates the index with around two thirds share. In an unrelated move, the Chinese government announced a plan to boost its stock market. This includes measures to encourage share buybacks, potentially lifting share prices, which reduces the number of available shares further.

EV tipping point crossed

Norway now has more electric vehicles (EVs) on the road than cars with internal combustion engines (ICEs). EVs make up 92% of new vehicle sales currently, with the country due to ban ICE sales altogether by the end of this year. EV sales are also booming in China, overtaking ICE sales for the first time ever in July. In the US, however, EV sales growth has stalled due to affordability concerns, lack of infrastructure and a short term shift towards hybrids. In contrast, EV sales in Germany fell almost 70% in August year on year after the government cut back financial incentives, threatening the EU’s deadline to ban new ICE sales from 2035.

On the radar

The clock is ticking down on the US presidential election. Vice President Kamala Harris has edged ahead of Donald Trump in nationwide polls. But the two are neck and neck in the seven swing states whose electoral college votes will decide the outcome.

Central banks have mostly started their easing cycles, with the US Fed enacting a larger-than-usual 50 bps cut in September, but the path from here will be data dependent. Brazil and Japan remain outliers and might announce further moves to tighten monetary policy.

US economic data announcements will be closely watched, after recent data indicated that the US economy is heading for a soft landing rather than a recession. While job growth has slowed it remains positive, and measures of consumer confidence have yet to fall sharply.

*Morgan Stanley Capital International All Countries World Index