How we invest

Our approach

Our multi-manager approach means we are free to explore the entire investment universe, working with a range of top-tier external asset managers, while also benefitting from the expertise of our colleagues across BNPP AM.

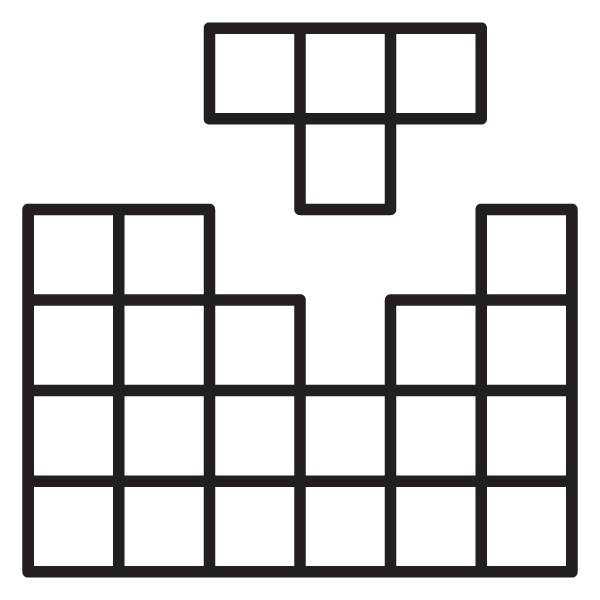

1. Manager preselection

Quantitative screening is an important element in our manager pre-selection process. Our proprietary in-house quantitative screening process reviews funds in each asset class using a number of low-correlated factors and this analysis helps us understand the reasons for the fund’s performance, highlighting those managers that deliver consistent returns.

2. Selecting managers

Rigorous due diligence is conducted on those funds and managers that have demonstrated excellent risk/reward characteristics in the quantitative analysis stage. We get under the skin of the manager, dig deep into their process and personality and try to understand how they might behave in periods of market highs as well as lows. Consideration of environmental, social and governance (ESG) factors has been a central part of our investment process for some time. We have fully integrated ESG considerations into our investment process, ensuring that all our offerings meet the high standards we have set for ourselves.

3. Constructing our portfolio

Our investment team looks for funds which complement each other and strike the best balance between risk and potential return. This involves an analysis of volatility and correlation of returns of each fund, along with examining how portfolio risk varies as weightings change.

4. Monitoring and risk management

Our investment managers regularly monitor and adjust the portfolios to keep funds in line with their objectives and to take advantage of new investment opportunities. We have an Investment Risk and Performance Team in place to carry out independent monitoring, ensuring the portfolios remain within risk and exposure guidelines.