Buying at the dip

Even during the relatively short period since the start of this century, there have been numerous severe market sell-offs. From the tech bubble of 2000-02 when the S&P 500 fell by 49%, 9/11, the sub-prime/global financial crisis of 2007-09, the Brexit vote in 2016 to more recent shocks such as the global pandemic shutdown and the war in Ukraine, investor confidence has been shaken. With the value of hindsight though, markets have always recovered.

In the face of a severe market sell-off, many investors may be mindful of the saying “this time it’s different” and be tempted to exit their positions, however, market evidence shows that such a move has been historically detrimental. Markets rebound and almost a century’s worth of US data shows that a 20-year holding period in US equities has never delivered a negative return.

There can often be attractive buying opportunities following market corrections. Whilst considering such an approach shortly after a market fall may be daunting, investors should remember that there exists the chance to take advantage of potential excess returns.

Market sell-offs

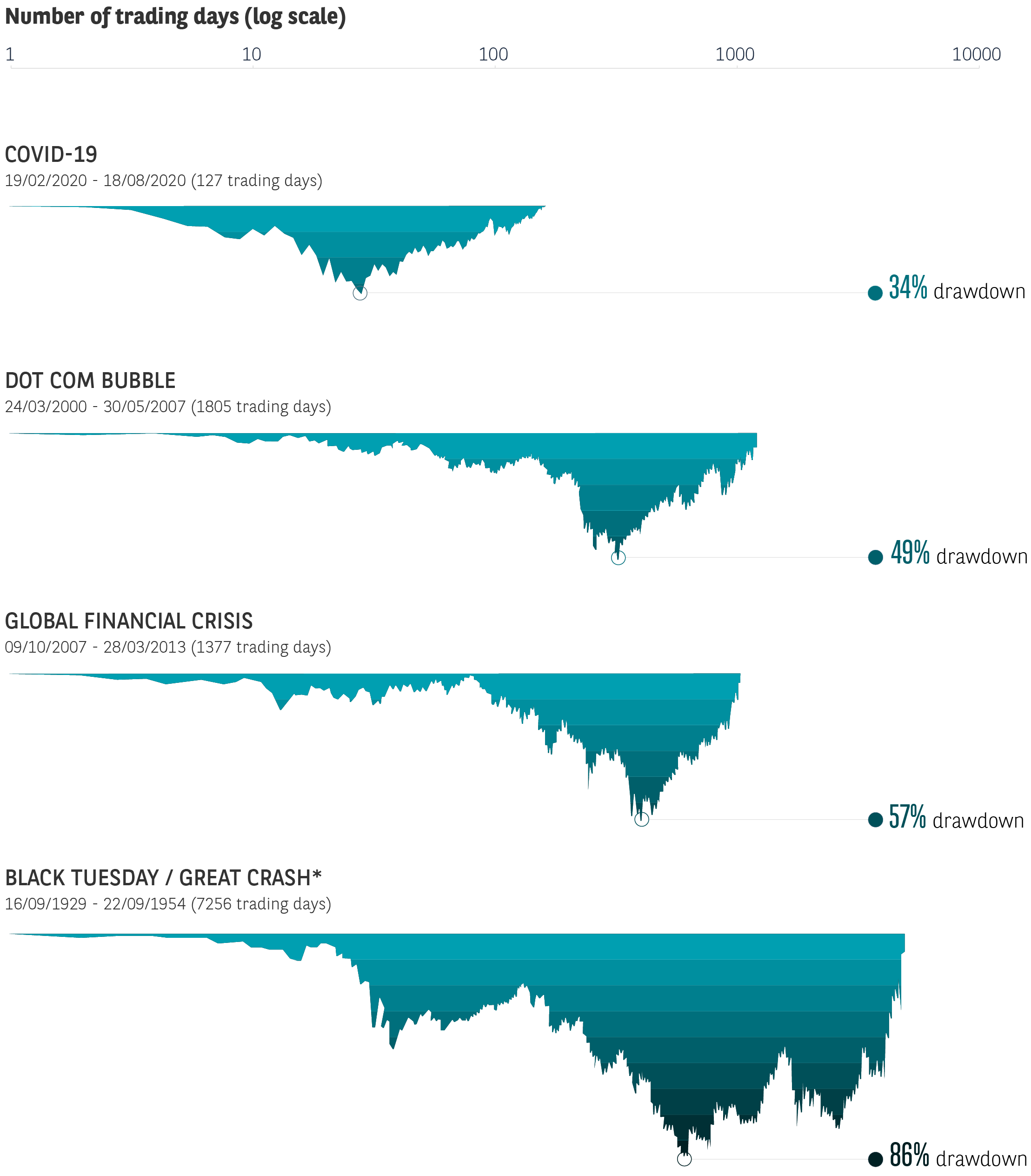

The chart below highlights how long major market sell-offs have lasted, and the comparible percentage drawdowns in the S&P 500.

Bloomberg, as at 31 July 2023. *Black Tuesday occurred about a month after the market peak on Oct 29, 1929. Maximum drawdown: the peak-to-trough decline of an investment over a specific time period. Quoted as a percentage of the peak value.

If there is one takeaway from index corrections, it is that no matter how severe or bleak prospects appear at the time, markets do recover. In other words, market selloffs are followed by upturns. Investors who stay invested or purchase more shares when prices are low and sentiment weak tend to experience a smaller adverse affect on their portfolio than those who sell during the downturn and hope to get back in later.

Guide to investing in volatile markets

From the importance of diversifying your portfolio to a five-point investment checklist, this guide highlights what to consider when investing in periods of market volatility.

Download guide