Long term investing

Long term investing

The history of long term investing

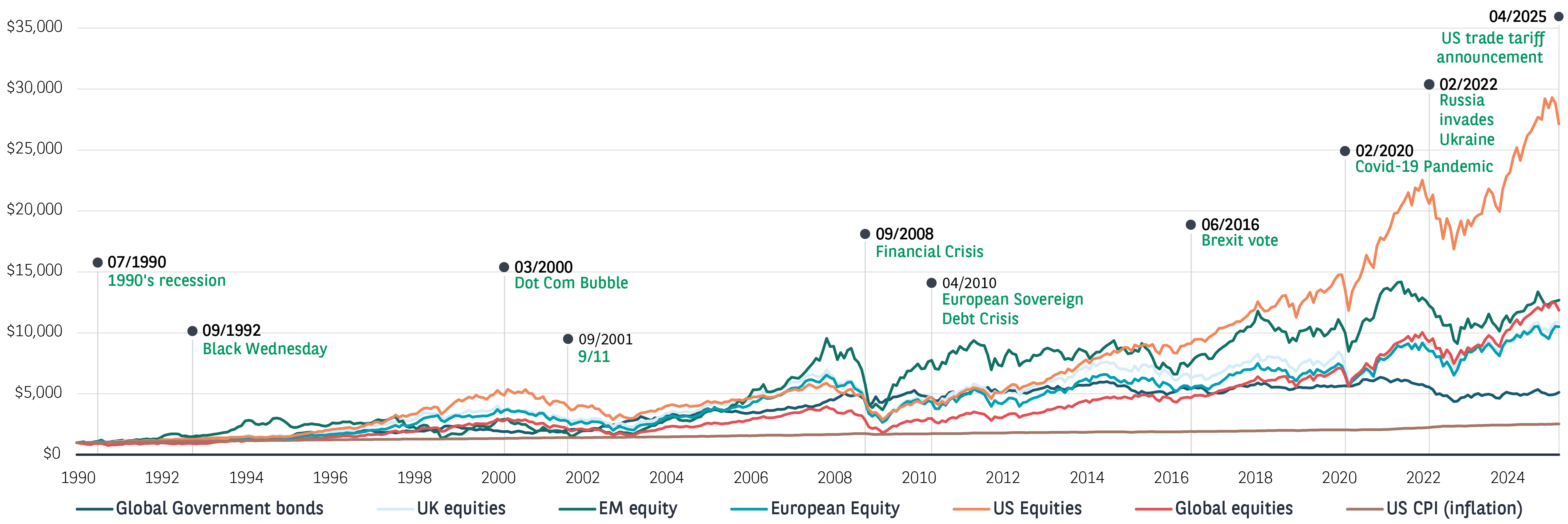

Over the years there have been many events that have had large impacts on financial markets, from black Wednesday in 1992 to the more recent financial crisis in 2008. However, as can be seen from the chart below, the long-term trend for market performance has continued to remain positive. If you are investing for the long term, while you will experience market dips and volatility from time to time, history has shown us that these events won’t stop the long-term positive performance of markets. It’s important to remember there are no guarantees though, and past performance is not a reliable guide to future performance.

Source : Morningstar, data 31 December 1989 to 31 March 2025. US dollars. Rebased to 1000. Past performance does not predict future returns.

Evolving benchmarks to represent the strongest companies

Remember that new names are entering and falling out of stock indices on a regular basis as they are ‘rebalanced’. In the case of the S&P 500, this takes place on a quarterly basis. Criteria for inclusion in the S&P 500 include a market capitalisation of at least $8.2 billion and positive earnings during the most recent quarter. The sum of its earnings over the previous four quarters must also be positive. Meeting the above requirements does not guarantee index inclusion, but the larger a company’s market capitalisation, the greater the chance of membership.

Guide to investing in volatile markets

From the importance of diversifying your portfolio to a five-point investment checklist, this guide highlights what to consider when investing in periods of market volatility.

Download guide