Annual Review 2025

That was the year...

2025 was the year of tariffs and tech. US President Donald Trump imposed “reciprocal tariffs” on most of the world’s trading nations. Markets briefly stumbled before rallying hard, propelled by the prospects for AI (artificial intelligence). Nvidia became the biggest company the world has ever seen. We present the pick of our top stories as the year unwound.

Trump 2.0

The inauguration of the 47th President of the United States initially brought a positive market response. A flurry of executive orders left the Oval Office. They ranged from 25% tariffs on Canada and Mexico, unwinding Biden era legislation, cancelling incentives to buy electric vehicles and a 75 day grace period to find a US purchaser for TikTok. The president repeated an interest in buying Greenland and in taking control of the Panama Canal. He called on OPEC to lower oil prices and for immediate interest rate cuts. US bond markets showed little reaction to that demand.

Asian tigers roar

Asia’s homegrown tech giants, known as the ‘Terrific Ten’, challenged the Magnificent Seven for stock market performance. In Hong Kong, the Hang Seng index soared by almost 20%, scorching ahead of the Nasdaq. The launch of China’s AI (artificial intelligence) platform, DeepSeek, was the initial trigger for the rally. Momentum then gathered as Tencent, China’s multimedia giant, switched to DeepSeek AI technology, dropping the development of an in-house version. And further impetus came when Apple signed a deal to integrate e-commerce tech giant Alibaba’s AI into all the iPhones sold in China.

BYD leads the charging

The share price of BYD hit a record high. The Chinese electric vehicle (EV) giant claimed its latest charging technology can deliver a full top up in five minutes, putting EV charging on a par with petrol station refuelling. Meanwhile, Tesla shares fell over 50% from their December peak, driven by negative sentiment towards founder Elon Musk. Hedge funds have made an estimated $16 billion by betting against the stock in the last three months. The sharp drop prompted unusual scenes on the White House lawn, where Tesla cars were on show, as the president promised to buy one himself.

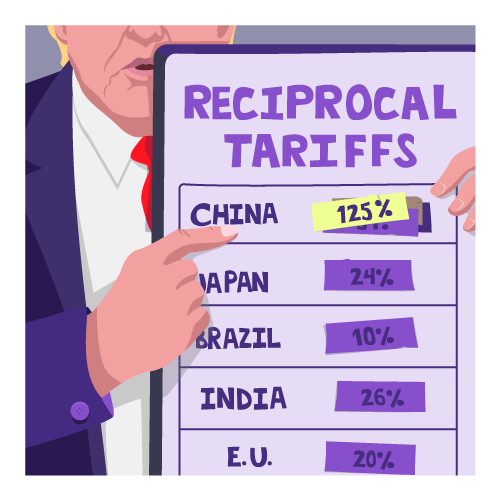

Tariffs yoyo

Liberation Day, so called by President Trump, saw tariffs averaging just over 20% imposed with immediate effect on all US trading partners. The imposition was then postponed for 90 days for all except China, whose levies were ramped up to 145%. US Treasury Secretary Scott Bessent later conceded these levels were “unsustainable”. Meanwhile, China urged the EU among others to maintain multilateral trade. The IMF (International Monetary Fund) cut global growth forecasts, particularly for the US, claiming tariffs will decrease competition and innovation in the long term. Nonetheless, the IMF’s forecasts would improve immediately once new trade agreements were forged.

Who blinked first?

The tariff war briefly de-escalated, after retaliations between the US and China were temporarily scaled back. It is not known who called it, but a meeting in Geneva was attended by both parties, after the squeeze on imports was felt at major ports. The situation later re-ignited, however, when the US threatened 50% tariffs on the European Union. Unsurprisingly, an index of trade uncertainty has gone through the roof. Meanwhile, US retail giant Walmart confirmed prices will be rising in June, despite being instructed to “eat the tariffs” by the US president.

Wait and see mode again

Speaking in Congress, the US Federal Reserve (Fed) chair Jay Powell commented that “uncertainty has diminished”, referencing a de-escalation of the trade war between the US and China. Nonetheless, opinion among Fed governors was split as to whether any tariff related inflation shock would be transitory or more persistent. Indeed, the cost of imported electrical goods such as fridge freezers began to creep higher, as tariffs on steel came into force. But President Trump, impatient with the pace of policy moves, called for big rate cuts and asked whether he could appoint himself as Fed chair.

Still fighting the Fed

The Trump administration continued its assault on the chair of the US Federal Reserve, Jay Powell. Once again, insults were used by President Trump, aiming to force significant interest rate cuts, or to install a more compliant candidate. The US Treasury Secretary broadened the attack to include “the entire Federal Reserve institution”, with the $2.5 billion refurbishment of the Fed headquarters firmly in his sights. Markets largely took these outbursts in their stride, with equities touching record highs, although the US dollar traded at lower levels. Powell himself appeared undaunted, and interest rates remained on hold.

Better and also cheaper

The long awaited ChatGPT-5 was launched by OpenAI. This latest AI tool offers enhanced capabilities at cheaper pricing levels, aiming to broaden demand. A response perhaps to Chinese competitor DeepSeek, whose lower priced AI tool rocked the sector earlier this year. OpenAI is reportedly in talks for a future share sale at a valuation of $500 billion, which would make it the world’s most valuable private technology group. Nonetheless, the US tech sector wobbled after research by the MIT (Massachusetts Institute of Technology) claimed that 95% of recent investments in generative AI have yielded zero returns.

FOMO rally continues

Propelled by the ‘Fear Of Missing Out’, equity markets rallied harder, likened by some to the ‘dotcom boom on steroids’. The Chinese tech sector further outstripped the Nasdaq, on AI advances and hopes for self-sufficiency in AI chip design and production. Not all markets joined the rally, however. Government bonds remained subdued, with yields at higher levels in the face of towering government debt. As budget difficulties in France brought two debt downgrades in one week, the benchmark government bond yielded more than the domestic bond issues of corporate champions such as L’Oréal, Airbus and AXA.

Circle of AI deals expands

OpenAI, the creator of ChatGPT, placed itself at the centre of a web of deals topping $1.5 trillion. Multiyear supply deals were signed with tech giants such as Nvidia, Oracle and Broadcom, aiming to guarantee delivery of ever increasing quantities of chips and computing infrastructure. The generative AI pioneer also moved to a new corporate structure, with Microsoft taking a stake of 27%. The circularity of these deals between suppliers, investors and customers was noted. Meanwhile, Nvidia became the first company to hit a valuation of $5 trillion.

Bubble or wobble?

Talk of a tech bubble swirled around markets, as big tech companies unleashed a barrage of capex plans. Their target is to accelerate the build out of AI capacity. As more, and more massive, plans were announced, markets questioned when returns on the investment might be achieved. Oracle and Meta were punished on overspending concerns. Some more speculative assets were dumped, and cryptocurrency markets suffered a $1 trillion rout. The bout of volatility was tempered sporadically by hopes of a Fed rate cut in December.

The festive wrap

As the old year closes and a new one begins, the markets remain focused on certain questions. Will the transformative potential of AI start to be realised? Or will huge capex spending plans fizzle out? Who will take the helm at the US Federal Reserve? And will interest rates then fall faster? Only time can tell how events will play out. In the meantime, we wish all our readers a happy and successful 2026!