Close Look - Where next for US earnings growth?

What is the context?

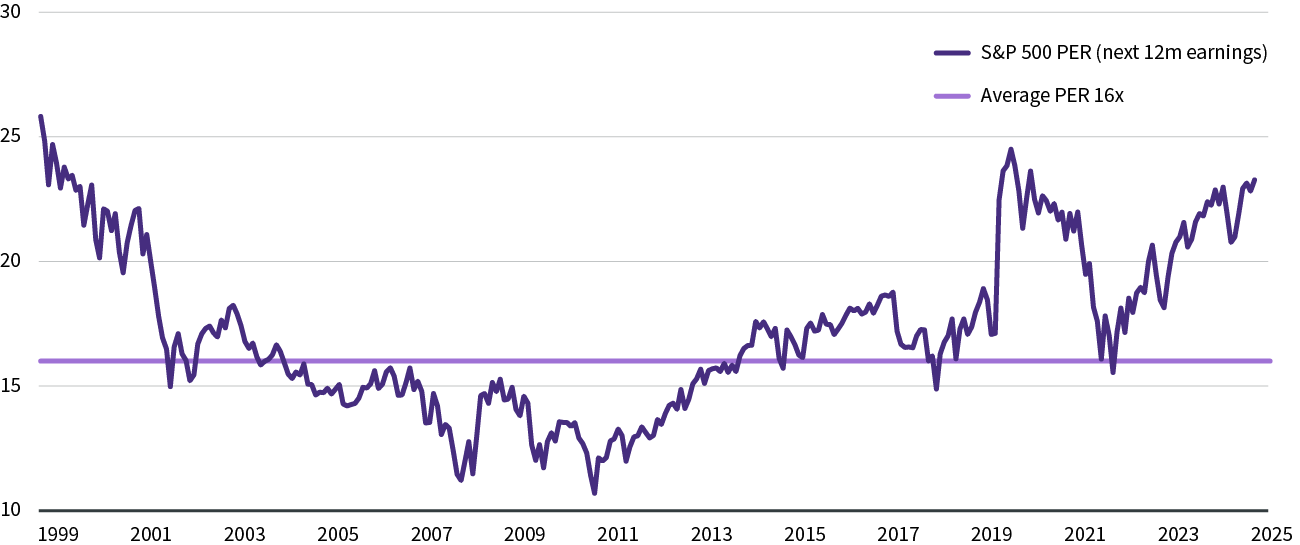

US earnings growth appears resilient, boosted by the exceptional profitability of the tech sector. But with valuations at historically elevated levels, the sustainability of this earnings growth really matters. As shown in the chart below, the PE (price earnings) ratio of the S&P 500 now stands at 23x the next 12 months earnings, well above the 25 year average of 16x. To move higher from here, equity prices might have to rely heavily on future corporate earnings growth. We review the quality of US corporate earnings growth, the challenges that lie ahead, and whether current levels of growth are sustainable.

S&P 500 forward PE ratios

Source: Bloomberg, 12 September 2025

What is the current growth rate?

The companies that make up the S&P 500 are typically strong and have good prospects. They include leaders in their field, such as the ‘Magnificent 7’ megacap tech companies, which have the potential to drive profits growth while resisting competitive pressures. These companies have managed to maintain or improve their profit margins by limiting new hiring and by passing on some price increases to their customers.

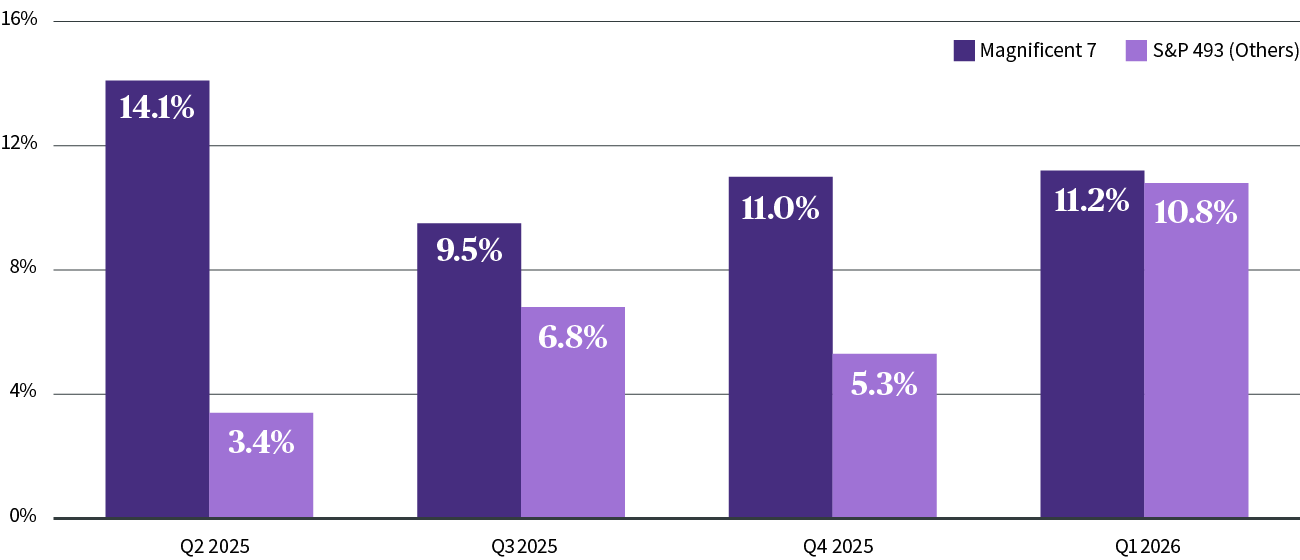

As evidence of this, in Q2 2025, more than 80% of S&P 500 companies reported a positive earnings surprise. As in many recent quarters, the growth was driven by the Magnificent 7. Nonetheless, earnings growth is expected to broaden in 2026. The remaining index constituents, known as the ‘S&P 493’, are expected to catch up with the 16% growth rate of the Magnificent 7, as shown in the chart below. With broader earnings growth across numerous sectors, analysts forecast average profits for the S&P 500 achieving double digit growth in 2026.

S&P 500 Expected Earnings Growth

Source: Factset, August 2025

Can tariffs derail this growth?

The US has increased trade tariffs from an average of 2.5% at the start of the year to about 18% now. But the big question remains unanswered- who will be bearing this cost? Recent research has shown that 46% of US companies have not so far addressed the issues raised by trade tariffs. However, the companies that have employed a strategy thus far appear to be splitting the burden between lower profit margins, expense and inventory management, and supply chain adjustment. Fewer than 20% of these companies have passed price increases on to their customers.

This blended approach emphasises the high level of flexibility among US companies. Nonetheless, a one off margin and earnings hit is being absorbed this year. This explains the lower growth rate for 2025, seen in the chart above. Indeed, excluding the Magnificent 7, earnings are only expected to grow by an average of 4% for S&P 500 companies.

Will AI boost US profit margins?

Despite the uncertain backdrop of recent years, US corporate profit margins have been surprisingly resilient. They are expected to rise further in 2026 and 2027. This could be related to the massive investment in AI (artificial intelligence) by the ‘AI hyperscalers’, such as Alphabet, Meta, Amazon and Microsoft. Some analysts believe that on average these companies are spending more than 40% of their cashflow on capex (capital expenditure), a sum which could top $300 billion in the first half of 2026.

In the meantime, only 9% of US companies are so far using AI to produce goods and services, although this is expected to accelerate in the coming months. Some industries are likely to adopt the new technology at a faster pace than others. More widespread adoption should bring productivity improvements and the potential for margin expansion, meaning sustainable earnings growth should follow.

AXA IM Select view

We recognise the high valuation multiples that investors must pay to own US equities. Such prices can be explained, not only by a supportive fiscal and monetary policy environment, but also by expectations that AI related investments will deliver greater productivity gains, stronger margins, and higher earnings growth for US companies in the future.

In this context, we remain positive on equity markets. However, we look to diversify across regions and sectors. Earnings growth can potentially broaden out beyond the technology sector, as more companies benefit from AI adoption. While earnings should also benefit from higher government spending, for example in the US, Europe and China, as well as supportive monetary policies.