Close Look - Geopolitical uncertainty - keep calm and diversify

What is the situation?

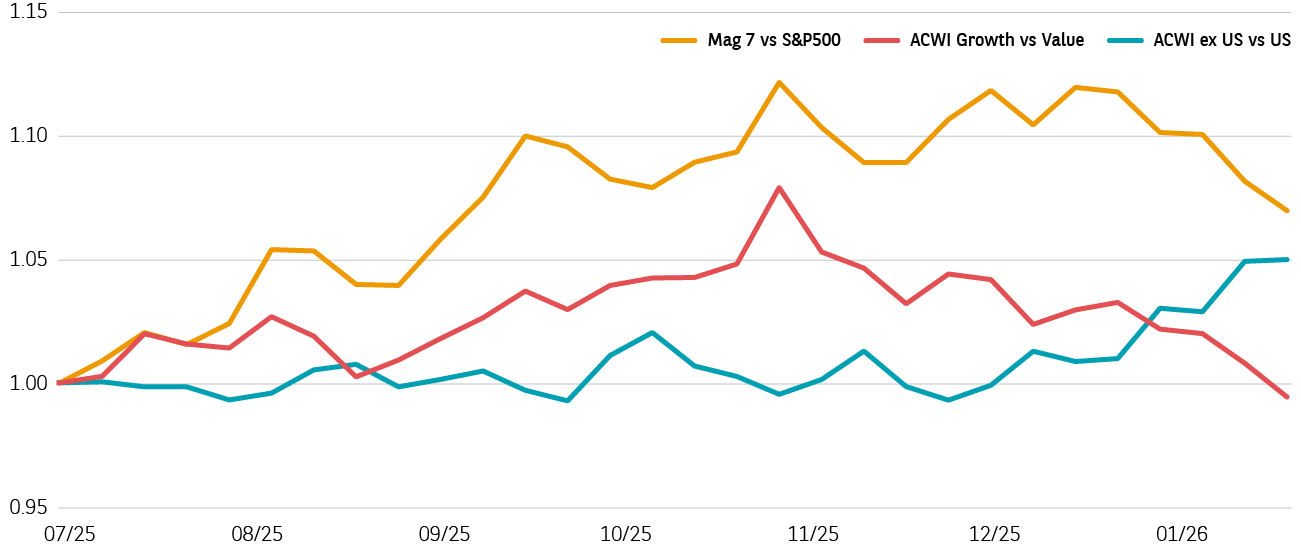

US and AI related stocks led the markets for much of 2025. But since October there has been a challenge to this leadership, triggered by elevated valuations, geopolitical uncertainties and massive capital expenditure on AI.

Spikes in equity price volatility have become more commonplace. Investors, including ourselves, have been increasingly looking to diversify their equity exposure away from the US and the tech sector.

US market leadership

Sources: BNPP AM, Bloomberg – all relative indices rebased 100 as of 4th of July 2025 and in USD net total return, relative indices calculated as ratios of the respective index values- MSCI ACWI World ex US, MSCI USA Index, MSCI ACWI World Growth, MSCI ACWI World Value.

What is the background?

Three factors could challenge the dominance of US equities observed since 2012, potentially resulting in volatility spikes. Following the Liberation Day imposition of higher trade tariffs, US trading partners have fewer surplus dollars to recycle back into US assets. This could mean reduced foreign support and slower upside moves than historically observed for US equities.

Second, the enthusiasm for the AI investment theme peaked in early Q4 2025, as valuations in the tech sector and their capex levels soared.

Added to this nervousness has come a new layer of geopolitical uncertainty. On national security concerns, President Trump ordered decisive action in Venezuela and Iran and threatened to take over Greenland.

Why does this matter?

Since last October, a rotation has been observed away from Growth (faster growth, highly rated) and US stocks in favour of international (ex-US) and Value (slower growth, lower rated) stocks. Such rotation is rebalancing the valuation premium of US and Growth stocks to healthier levels.

Added to this, the excessive use of tariffs and force by the US administration presents markets with uncertain outcomes.

Combine these two factors with historically higher valuations and the result can be a bout of volatility, when asset prices swing wildly.

How can diversification help?

Global equity market indices are concentrated in US and tech equities (70% and 23% of the ACWI respectively). Investors might be looking to benefit from the higher earnings growth and lower valuation of international (ex-US), quality and value stocks. Better diversification can offer an upside participation to the “earnings broadening” and the “challenged US dominance” themes, by way of a wider blending of sector and regional exposure.

In addition, gold has historically delivered low to negative correlation to both equities and government bonds during periods of geopolitical stress and policy uncertainty. It may also provide effective protection at times when inflation risk or fiscal concerns rise, compared to long maturity bonds.

Our view

The current environment could bring higher levels of equity volatility than observed last summer. Investors should get used to wider price fluctuations.

One way to reduce the impact of these swings is to diversify regional, style and sector equity exposures away from US and Growth stocks. We prefer to gain equity exposure through European, Emerging market and Japanese stocks. In addition, a gold allocation may offer better diversification than a bond allocation with regard to geopolitical, budget deficit and inflation risks, increasing portfolio resilience to shocks.

2026 could offer attractive opportunities and diversification should play a particularly important role in an investment portfolio.