Close Look - Are we in a tech bubble?

What is the situation?

The stock market will always have both winners and losers. In recent times, this has felt more extreme than usual as a handful giant tech stocks, especially those which are part of the AI revolution, have been driving the market's gains. However, this is not a new phenomenon.

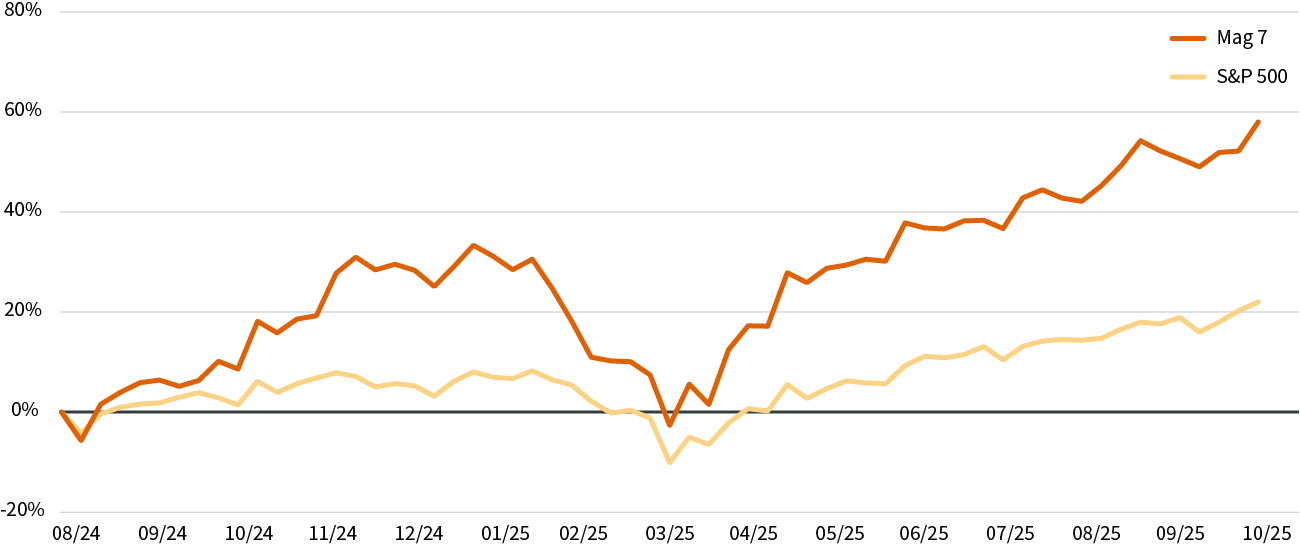

Performance of the Magnificent 7 and the broader S&P 500: August 2024 - October 2025

Source: AXA IM Select, Bloomberg, 29 October 2025. Magnificent 7: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla

What is the background?

Back in the day we had the ‘Nifty Fifty’, a group of 50 popular, high growth US stocks, like Coca-Cola, IBM and Polaroid, which investors believed to be ‘can't lose’ bets. Until many of them crashed in the 1973-74 bear market, proving even ‘safe’ stocks can be overpriced.

In the 1990s we had the ‘dot com’ leaders, high-flying internet companies, like Amazon, Cisco Systems and Yahoo!, which investors believed would dominate the future. Until the dot com bubble burst in 2000, wiping out trillions of dollars in value, proving that hype doesn’t guarantee profits.

What’s different this time?

Markets appear to have completely bought into the ‘AI as transformative technology’ narrative, reminiscent perhaps of the buzz around the rollout of the internet back in the 90s. In the same way, the concentration of capital on a few big names is not unfamiliar.

However, today the leaders in AI are already highly profitable companies, and they are financing their investments from free cash flow, not debt or equity. Back then internet enabling infrastructure was incomplete and still needed to be built out. For AI, although it is energy greedy and large investments are seemingly announced every day, everything is in place to allow rapid adoption. With every quarterly report the AI-related leaders are beating expectations and generating more cash.

The final nuance of difference could be that, while a good deal of hype surrounds AI, the technology does indeed appear to have revolutionary potential. Although the sector might go through cycles as with any other, it could have a long future ahead of it, based on the valuable infrastructure that is being built out.

Picking the winners

Given the dominance of the Magnificent 7 stocks this year, it would be tempting to just invest in those companies exposed to the AI revolution. However, their popularity has made them increasingly expensive to own. Investors are expecting companies to show strong earnings growth into next year. We are keeping a close eye on the delivery of forecast earnings growth associated with these high valuations.

AXA IM Select view

The current environment remains supportive for global equities. Elevated valuation multiples can be justified by the fiscal and monetary backdrop, as well as by positive corporate earnings growth momentum.

However, as a handful of giant tech stocks have dominated market performance, many investors are now asking if this is a bubble.

In our view, we are not in bubble territory yet, although some parts of the market might be. These include crypto-related assets and certain AI data centres. We might see periods of volatility as markets are pricing in optimistic forecasts.

We maintain a preference for global equities, with broad regional diversification. Indeed, this year’s rally could broaden out of the tech sector and across other industries thanks to improved productivity and increasing AI adoption, as well as favourable fiscal and monetary regimes. We also retain some exposure to corporate credit, expecting total returns amid low default rates to exceed those of cash and long-term government bonds, particularly in Europe.