What do handbags have in common with volatile markets?

What do handbags have in common with volatile markets?

What investment return can you expect from a luxury bag? Well, according to Knight Frank’s 2025 Wealth Report, quite a good one, but the amount depends very much on your time horizon.

Whilst financial markets soared in 2024, luxury handbags only delivered an annualised return of 2.8%. Had you held the same luxury handbag for 10 years, it would have delivered you a return of 85.5%. Compare this to other luxury goods (see below Knight Frank’s Luxury Investment Index) like classic cars, fine watches, and rare whisky and you’ll see their returns can be relatively volatile in the short term, but largely positive in the long term.

The Knight Frank Luxury Investment Index (Kflii)

Q4 2024

| 12-month % change | 5-year % change | 10-year % change | |

|---|---|---|---|

| Kflii | -3.3 | 21.4 | 72.6 |

| Handbags | 2.8 | 34.0 | 85.5 |

| Jewellery | 2.3 | 20.2 | 33.5 |

| Coins | 2.1 | 23.6 | 47.5 |

| Watches | 1.7 | 52.7 | 125.1 |

| Cars | 1.2 | 29.5 | 58.9 |

| Colour diamonds | -2.2 | 4.8 | 3.8 |

| Furniture | -2.8 | 60.5 | 140.9 |

| Whisky | -9.0 | -9.9 | 191.7 |

| Wine | -9.1 | 8.3 | 37.4 |

| Art | -18.3 | 1.9 | 54.0 |

Drawing parallels with your investment portfolio

Why am I talking about luxury goods? Well, their performance in terms of growth can offer many parallels to investing in stocks and bonds. Luxury goods can also suffer similar changes in price in the short term, due to fluctuations in demand, but over the long term tend to deliver strong absolute returns. This is well evidenced by Knight Frank’s Luxury Investment Index, where over a 1 year time horizon, only 5 out of the 10 ‘collectibles’ sectors they track managed positive returns in 2024. Over a 5 year period this was 9 out of the 10, and over 10 years all sectors delivered positive absolute performance. When there are periods of negative sentiment in the economy, you don’t hear many stories of people panic selling their watches, cars or handbags at any price. Yet, many investors can fall into this trap when it comes to their investment portfolio.

The perils of panic selling

Panic selling is a detrimental behaviour driven by fear and irrationality. When investors panic sell, they liquidate their assets prematurely during market downturns, often at a loss.

If you are an investor with a return objective (or said another way, an investment goal), then this behaviour can be akin to jumping out of a plane the moment you experience some turbulence. When in reality, you should be keeping calm, managing your stress and staying on course. The behavioural bias linked to this reaction is one I’ve written about before. It’s called loss aversion, whereby people tend to fear losses more than they value gains, leading them to make impulsive decisions aimed at avoiding further losses.

For real assets, like those mentioned in the Knight Frank Index, but also alternative asset classes which are growing in popularity like infrastructure, private debt and private equity, we see that investors tend to take a long term view, which supports long term positive returns. Admittedly, this long termism is also driven by the lack of ease in selling these assets quickly, but I would argue this supports the overall end result of delivering positive long term performance.

So, the real question here is, doesn’t it make sense to take a long term view on equities and bonds just as we do for real asset classes…?

The wisdom of Warren Buffett

Warren Buffett, one of the most successful investors of all time, epitomises the benefits of long term equity investing. As of April 2025, Warren Buffett is ranked 5th on the list of the world's richest people. His net worth is approximately $165 billion[1].

Buffett's investment strategy revolves around investing in the stock of a company with strong fundamentals at a reasonable valuation. Crucially he will then hold the stock for years, if not decades. His investment in Coca-Cola is a prime example. Buffett purchased Coca-Cola shares in 1988 and has held them ever since, reaping substantial dividends and capital appreciation on the shares.

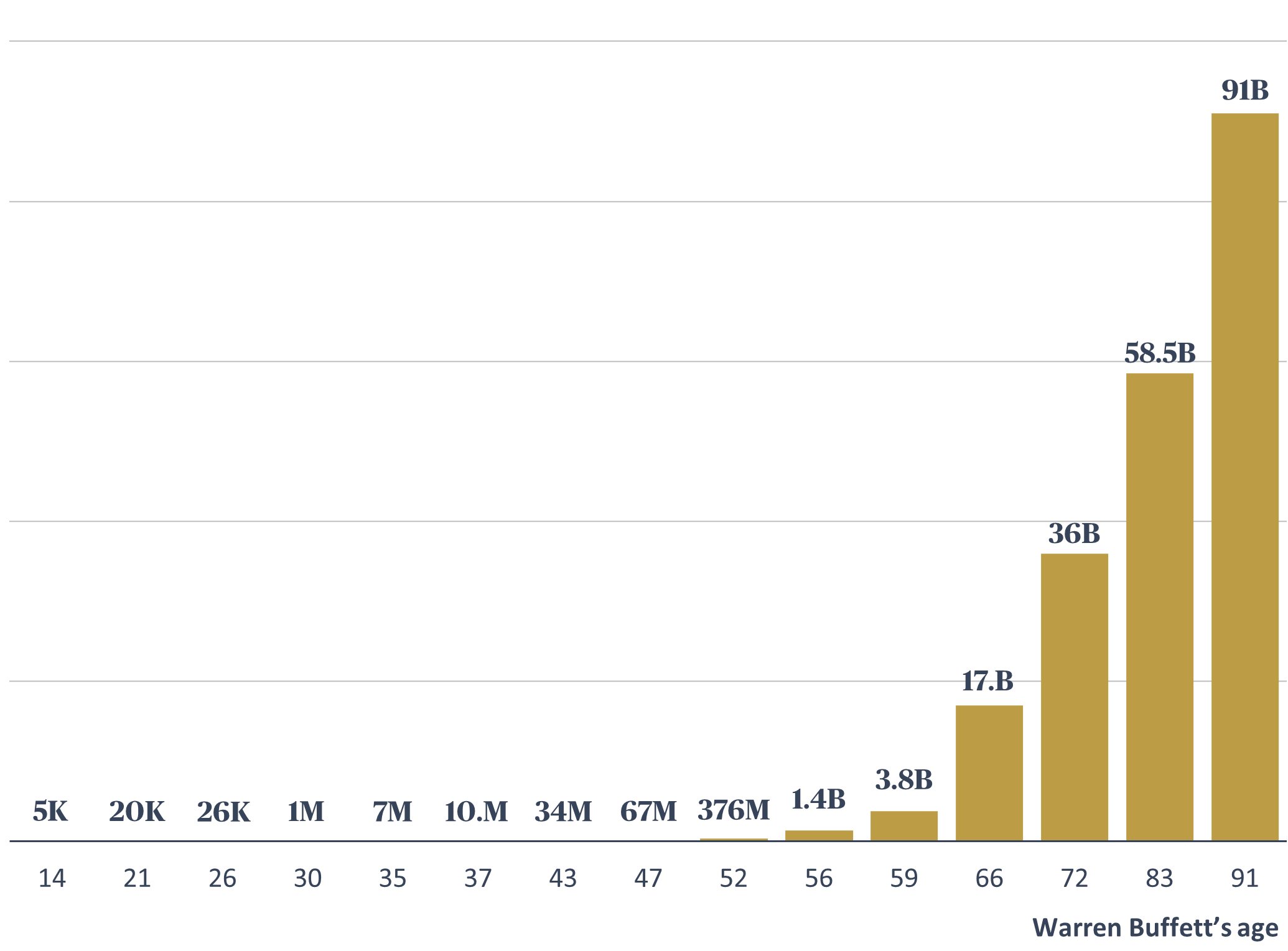

What Buffett has also realised is that wealth compounds. If you look at Warren Buffett’s fortune, most of it has been amassed in the final third of his life due to this powerful compounding effect.

Source: Finmasters, April 2025

[1] Forbes, 28 April 2025

Ignore the noise

What Mr Buffett’s enormous net worth shows is that the challenge with equity investing is not simply generating returns, but rather handling the ‘noise’, so that you remain invested over the long term. To put the impact of this noise into context, we ran a study on the S&P 500, looking at the number of positive/negative returns over different time periods. The results make for sober reading. They also show exactly why noise plays a key role in returns and investor behaviour.

If you were to look at the returns of the S&P500 every single day since 1927, you would find that returns are positive only 54% of the time. This means that nearly half the time, the market is down on a daily basis. This is an alarming statistic which could certainly put anyone off investing if you were to be so frequently subjected to negative returns (or as I will now call it – noise!).

But, if you didn’t look at returns every day, and instead, looked at them once a week, you increase the likelihood of seeing a positive return 57% of the time.

If you go one step further and only looked at performance once a month - the likelihood of seeing a positive return is now 61%.

And if you closed your eyes (and ears) for 12 months, and only looked at returns once a year? Yes, you guessed it right, it is higher with performance being positive 71% of the time.

This noise can be a crippling factor in an impossibly loud market.

Frequency of S&P 500 positive and negative total returns

| Daily | Weekly | Monthly | Yearly | |

|---|---|---|---|---|

| Positive | 54% | 57% | 61% | 71% |

| Negative | 46% | 43% | 39% | 29% |

| Total | 100% | 100% | 100% | 100% |

Source: AXA IM Select, S&P 500 return (30.12.1927 - 31.12.2024)

So whilst there are parallels, perhaps my article should flip the initial question to “What do handbags not have in common with volatile markets?” – well, handbags don’t price daily, and this lack of noise alone is probably enough to stop people from panic selling that lovely Birkin (if you could afford one in the first place!), and reap a healthy price appreciation over time.

Perhaps in this current market environment, ignoring the noise and taking a long term view is not such a bad option.