It’s all about inflation

It’s all about inflation

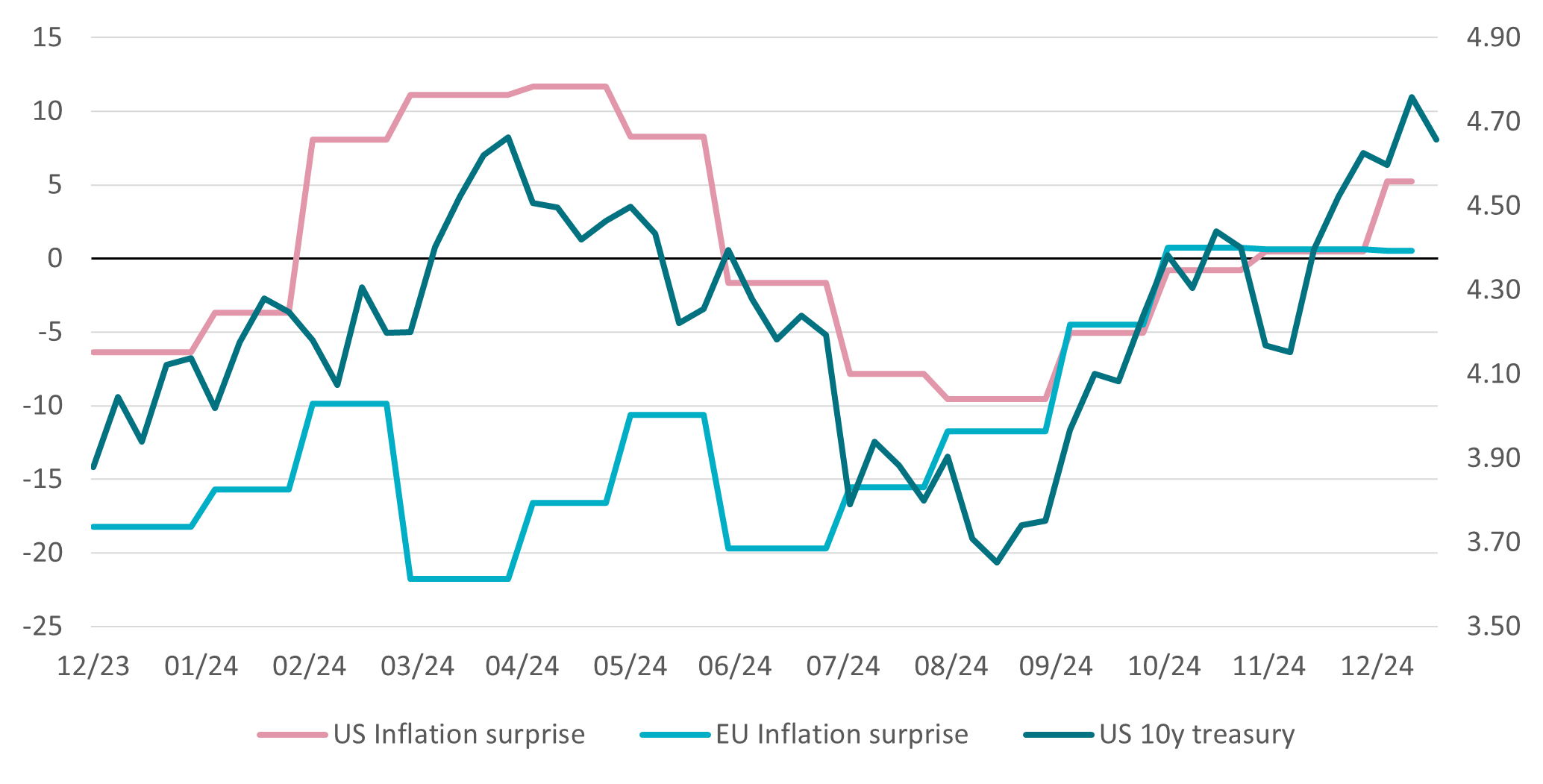

Equity, bond and currency markets have all had a volatile period over the turn of the year. One culprit seems to be the higher inflation expectations that have grown over the last three months across the US, Europe and Japan.

- In the US, the ISM price paid for services survey jumped to 64 in December 2024 from 58 a month earlier.

- The Eurozone 12 month median inflation expectation has risen from 2.4% to 2.6% since September 2024.

- In Japan, the Tankan 1 year inflation expectations remain sticky around 2.4%.

Most government bond yield curves have steepened in line with these upwards revisions, on average between 30 basis points (bps) and 50 bps over the month to mid-January.

Source: AXA IM Select, Bloomberg, Citi, 16 January 2025

What has changed?

After these weeks of uncertainty, December consumer price inflation (CPI) numbers released in the UK and US served to create some relief in the bond market, as well as for central bankers over the short term. Both prints were slightly better than expected, while the Eurozone CPI was stable.

Our economist noted these key points about the US data of 2.9% for December, with core CPI (excluding food and energy) at 3.2%:

- There has been no pick-up in inflation momentum, though the number remains above the mandated target of the US Federal Reserve (Fed).

- The Fed may see parallels with the late 1990s, where stronger productivity growth allowed the Fed to remain more dovish, favouring looser interest rate policy than the growth backdrop would seem to suggest.

What does this mean for interest rates?

We still expect one rate cut in March and a pause until the second half of 2026. Nonetheless, the ‘dot plot’ from the Fed’s December meeting hinted at two cuts this year, two cuts in 2026 and one cut in 2027.

So, are we out of the woods?

While this data is encouraging, the risk remains on the upside for inflation:

- The data have yet to be revised, always a possibility after last year’s Q1 surprises.

- The Fed may remain cautious on growth, trimming rates as early as March, as suggested in the FOMC meeting minutes.

- There is still uncertainty about the pace and scale of President Trump’s policies, particularly on tariffs and migration.

What does this mean for our asset allocation view?

We remain neutral government bonds for now. However, we are approaching more attractive valuation levels for government bond markets. The change in yields is removing some pressure on US small caps, one of the market areas we believe has potential. The US dollar remains resilient at this stage.