Close Look - What is behind the fall in the dollar?

What is behind the fall in the dollar?

After a strong performance in 2024, the US dollar has weakened this year, as investors have taken flight away from the world’s reserve currency. Taken together with stock markets which are not much higher now than they were at the end of 2024, it means some investors are questioning their portfolios’ dollar exposure.

What is pulling the dollar downwards?

There are four main factors which have led to a fall in the dollar, namely:

- Trade tariffs are expected to put a dampener on US growth compared to the rest of the world.

- The US debt level could be growing to a projected 118% of GDP (the total of what the country produces) over the next 10 years, if the ‘Big Beautiful Bill’ is adopted, up from 97% in 2024. This makes some investors wary of holding too much of the currency.

- Senior officials in the administration have hinted they would like a weaker currency, to help with US trade competitiveness. This is happening as the dollar has been overvalued against most global currencies for the past few years.

- Several large central banks are diversifying their reserves and as such, are reducing their dollar reserves in favour of other assets. At the end of 2024, gold accounted for 20% of global official reserves, with the euro at 16% and the dollar at 46%

What does this mean for investors?

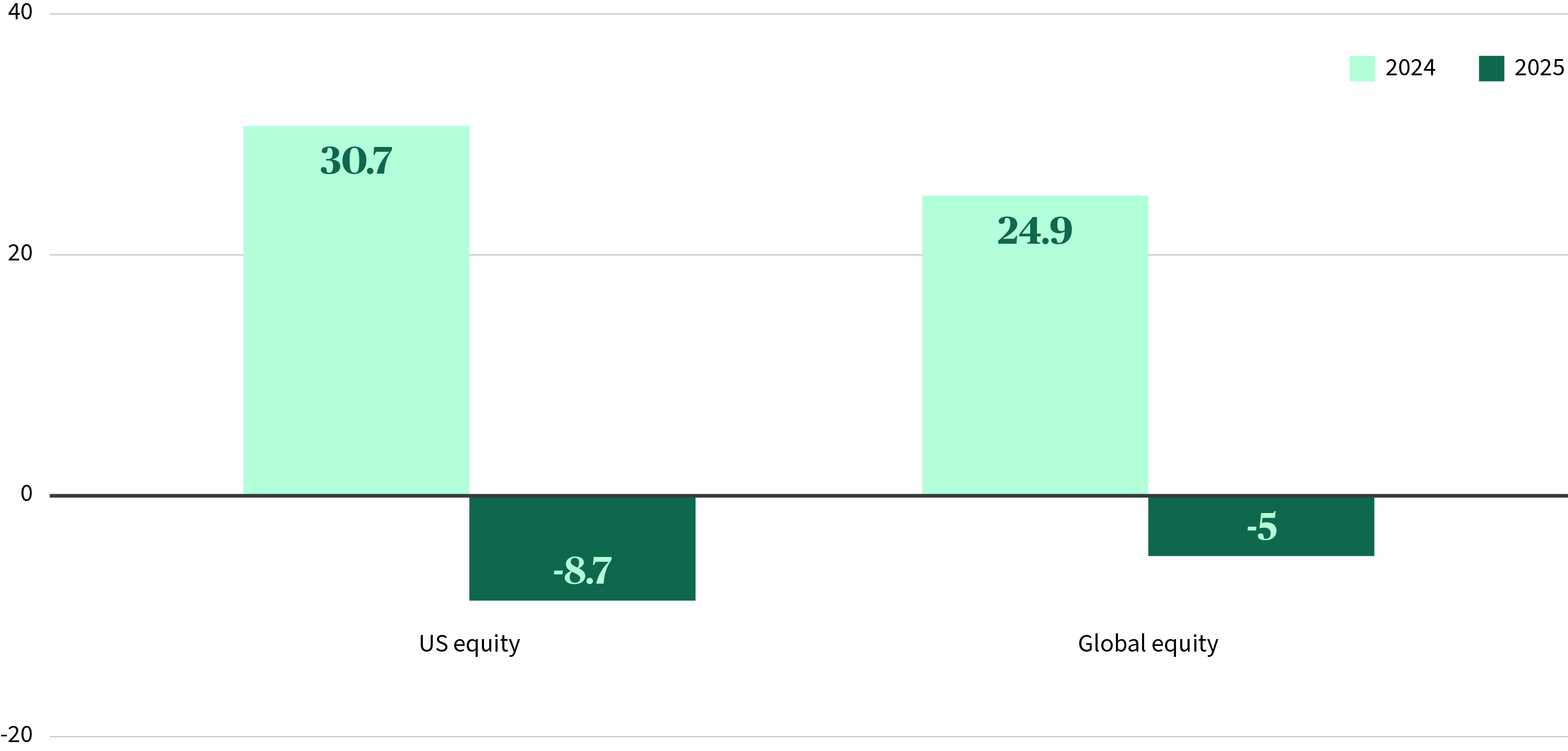

An investor’s return from a foreign share depends on the share price performance, as well as the movement of the share’s currency against their local (domestic) currency. For example, in 2024 when the S&P 500 had a net return of 24%, combined with the dollar appreciating by more than 7% against a basket of currencies, many non-US investors would have seen a return of over 30% in their local currency.

Historically, the dollar and US treasuries were considered safe haven assets in volatile times. As the dollar strengthened, this exposure has been a shock absorber when share prices fell. However, since the start of this year, the picture is markedly different (as the chart shows), raising the question of whether the dollar remains the safe haven it once seemed.

Net total returns of S&P 500 (US) and MSCI World (global) equity indices converted to euro.

Source: Bloomberg, AXA IM Select, 31 May 2025

Is it time to review dollar investments?

Some euro investors may rightly ask if they should reduce their dollar exposure. This depends on individual exposure for every investor and there is no one-size-fits-all answer, but we can consider broad ranges.

For context, most global funds have roughly two thirds of their assets in the US, meaning an investor would have approximately 70% exposure to the dollar.

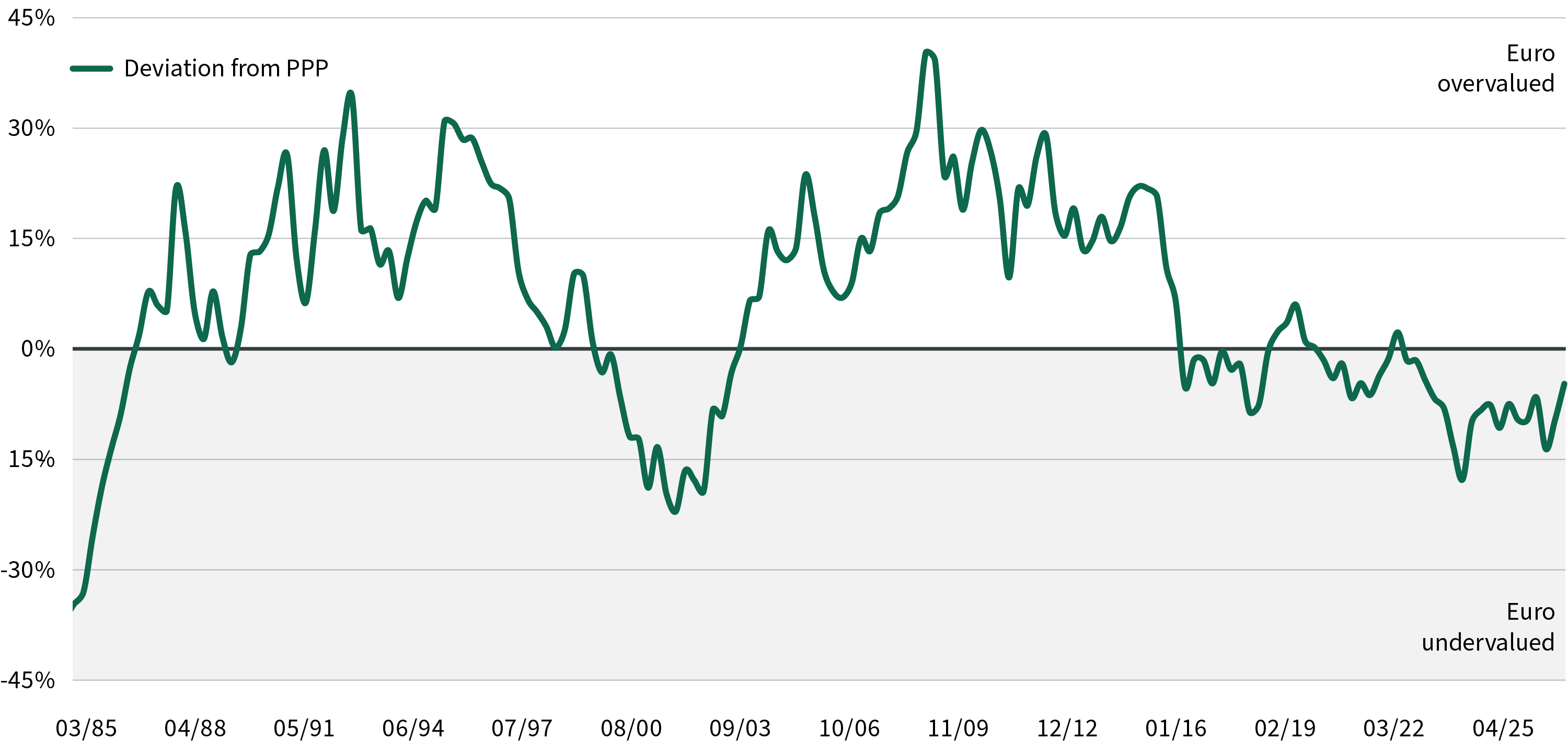

Euro investors may consider holding no more than 50-75% of their equity weight in dollars. This is due to a combination of the dollar’s lingering overvaluation (as the chart shows the euro is still somewhat undervalued against the dollar) and the cost of protecting against the currency risk. For euro investors, it currently costs approximately 2.8% per year to hedge against the dollar.

Investors looking to reduce their dollar exposure might switch some of their holdings to currency-hedged versions of US funds. Alternatively, they could diversify some of their US fund holdings into European, Japanese or broader global equity funds.

EUR/USD compared to its purchasing power parity, a measure of long-term valuation

Source: Bloomberg, AXA IM Select, 31 May 2025

AXA IM Select view

It is clear investors are losing trust in the dollar, but this sell-off is not the end of the currency’s reign. Given the ongoing tariff uncertainties, our model portfolio does not have any regional preferences. We have a neutral exposure to the dollar versus the euro, as we believe the exchange rate is close to its fair valuation level.