Close Look - Trade tariffs - motivation and consequences

Trade tariffs - motivation and consequences

After many decades when the globalisation of trade was highly prized, the second Trump presidency seems determined to disrupt the established world order and fast. The results of the America First Trade Policy investigation are due in early April, when the goal of reciprocal tariffs will also be assessed. The big question is why. Or perhaps why this time. We take a view on the motivation for the recent rash of trade tariffs and attempt to identify the intended as well as the unintended consequences.

What has happened?

Since the inauguration of President Trump in late January, tariffs on imports from major trading partners such as Canada and Mexico, China and Europe, have been slapped on thick and fast. A number of them have just as swiftly been postponed. Some, such as steel and aluminium tariffs on the European Union (EU), have been met with retaliatory tariffs on an equivalent value of goods. This whipsawing of policy, as well as the tit-for-tat responses, has left financial markets reeling. Rising levels of uncertainty over what might happen next have brought an escalation of volatility in their wake, indicated by a sharp rise in the VIX or 'fear index'.

Examine the motivation

Let's first look at the motivation behind these tariffs. Trump was elected on a promise to "Make America Great Again". His aim was re-industrialisation, or the rebooting of US manufacturing industry, which has languished in the face of cheap imports from more competitive economies. The imposition of tariffs on imported goods, including cars, aluminium and steel, was intended to create more favourable terms for home grown producers of these items. It forms part of a strategy known as 'reshoring'.

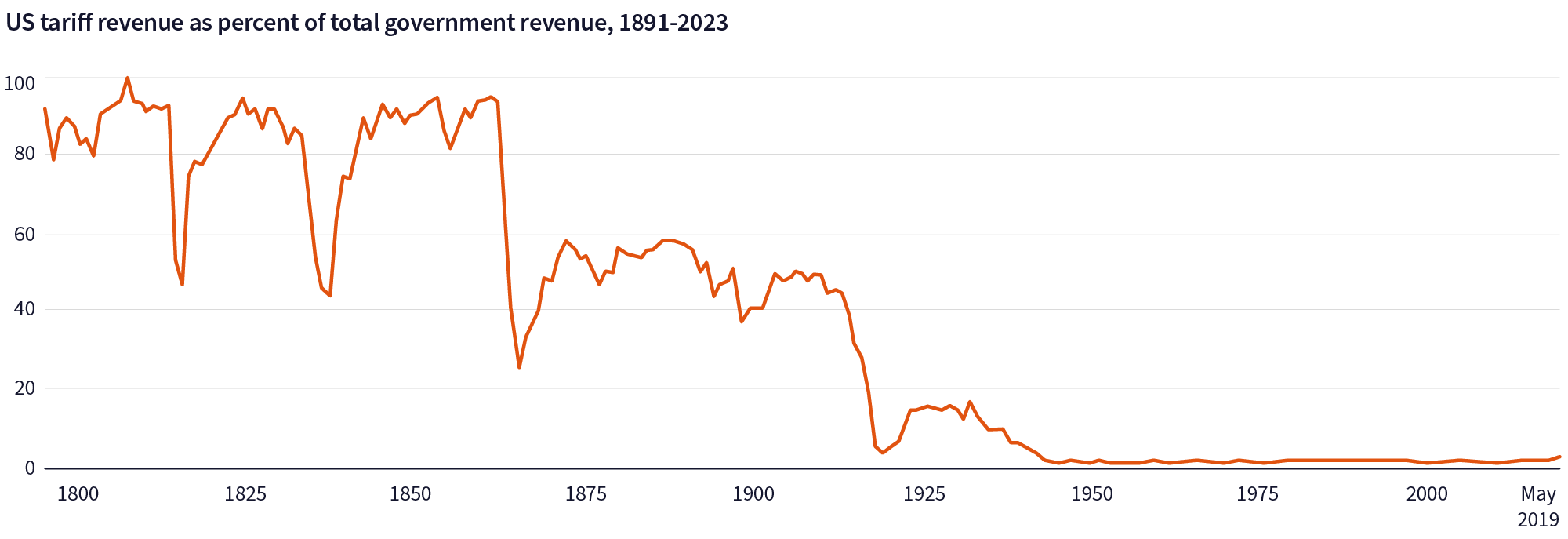

There is a further motivation, which might be just as significant for the new president. Tariffs on imported goods will raise revenue for the US Treasury. As the chart shows, this was historically a very significant source of income for the state, and the intention is that it should be so again. It seems that President Trump is looking to use trade tariffs to fund the extension of his first term tax cut, as well as new corporate tax cuts, while lightening the burden on the US budget deficit.

Source: Peterson Institute, February 2025

And think of the consequences

While the intended consequence of Trump's policy announcements is to destabilise existing trade relationships, as well as to boost revenue raising, the unintended consequences are worth a glance. Confused about the switch from the promise of stronger growth to the possibility of recession, US equity markets have fallen sharply, while corporate investment plans have been put on hold.

US bond markets have risen, partly due to their safe have status, but also in reflection of these lower growth expectations. It appears investors have lost faith in their president's focus on improving the economy and defending US business. What is more, the imposition of tariffs on imported Canadian oil and gas could even lead to higher energy costs, which would prove damaging to US industry. Elsewhere, the OECD has downgraded growth forecasts for the majority of the G20 economies, in the face of this escalating trade war.

AXA IM Select view

Financial markets hate uncertainty, always preferring a clear direction in policy, however unfavourable it might seem. As long as US policy on trade remains both aggressive and changeable, the result will likely be market volatility. In the face of these uncertainties, we have chosen to neutralise our regional equity allocation, pending more clarity on valuations, earnings revisions and the economic and political outlook. We also remain neutral on equities as an asset class, a position we have held since Trump's election. Although the idea of "American exceptionalism" is being questioned in the short term, it is still too early to say that there will be a definitive shift in market dynamics. Meanwhile, volatility could remain elevated, and we will keep a close eye on economic and monetary policy developments.