Close Look - February 2025

Is cash still king?

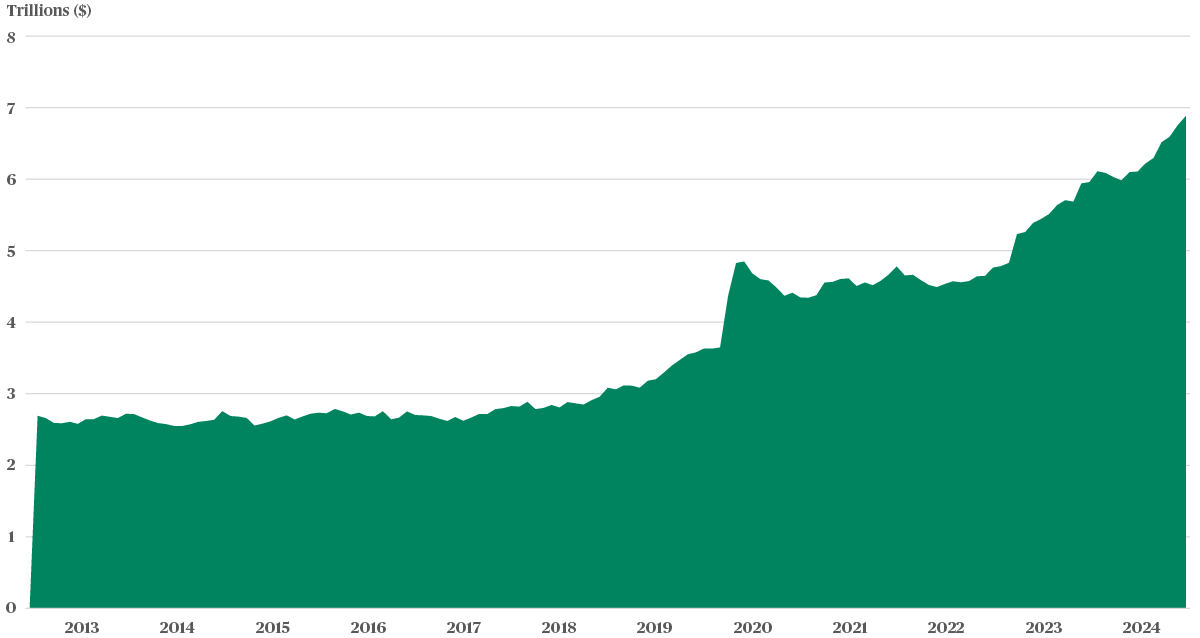

2024 was a record year for investors holding money in cash, that is savings accounts or term products. Just in the US, more than $925 billion flowed into money market accounts. This brought the total US money market assets to a record $6.9 trillion at the end of 2024.

US money market fund assets: $6.9 trillion, as at 31 December 2024

Source: Investment Company Institute, January 2025

Meanwhile, the US stock market had a stellar year, with the S&P 500 returning 23% in the same period.

So why would investors remain on the sidelines, even in the face of better returns achieved elsewhere?

In search of safety and yield

Last year’s inflows were a continuation of a trend that gained ground in 2020. The uncertainty brought about by the pandemic led many investors to seek the safety of cash, even if this meant lower returns. Following the pandemic and years of record low interest rates, major central banks raised rates to combat high inflation around the world. This served as a further incentive for investors to flock to the certainty of guaranteed returns, at a higher rate than they were previously used to.

However, as we enter 2025 conditions are changing. After emerging from the uncertainties of the previous few years, the world economy looks to be in a better state, notwithstanding several market-moving events since the start of this year.

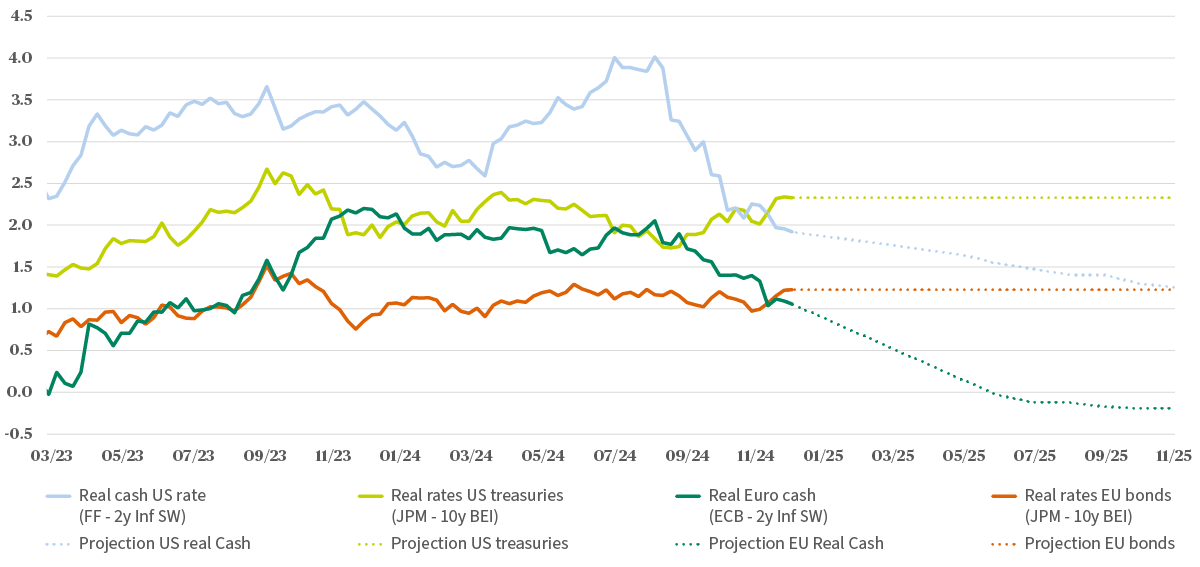

Real bond yields compared to real cash yields and projected real cash yields

Source: AXA IM Select, Bloomberg, 31 December 2024

The world’s largest economy has avoided a recession and central banks have started to cut interest rates. They are set to continue doing so over the coming two years, making savings accounts less attractive to keep investments in, as they will likely offer a lower yield than investors have become accustomed to over the last few years.

Investors who seek a real yield, or for their investments to earn more than inflation, may need to look elsewhere for returns.

Where to for investors in 2025?

Overall, economic conditions appear favourable for the coming year, as AXA IM’s economists expect global growth to remain above 3%. However, there are increasingly divergent performances for different regions. We expect US exceptionalism to continue in the stock market. For investors concerned about lofty tech valuations, we anticipate that improving earnings growth will broaden to a wider range of sectors, as well as smaller companies. Though, we remain mindful of valuation levels.

Within fixed income, we have a preference for global high yield bonds. These assets have benefited from the positive growth environment and low default rates.

While conditions have improved since the uncertainty investors faced in 2020, it is still not a straightforward picture. We believe active portfolio management and diversified portfolios will be needed for this year.