Close Look - De-escalation of the trade tariffs

De-escalation of the trade tariffs

A spike in market volatility followed Liberation Day, when the US imposed its ‘reciprocal tariffs’ on all trading partners. The subsequent de-escalation, including the postponement of many tariffs and an agreed reduction in US-China tariffs for 90 days, has caused US equity markets to rally strongly. Nonetheless, valuations are high and there is still uncertainty as to final tariff levels and any impact on corporate earnings. In the words of the old saying, will markets now be looking to “sell in May and go away”? We present our latest strategic view.

What has happened?

The US administration announced a 90 day postponement of all but its 10% baseline tariffs a week after Liberation Day, even as President Trump posted “great time to buy” on social media. Markets rallied, as fears of recession or even stagflation (rising inflation and lower growth) in the US retreated. A further boost came from the de-escalation of tit-for-tat tariffs between the US and China, which had escalated to the level of a trade embargo, for a period of 90 days.

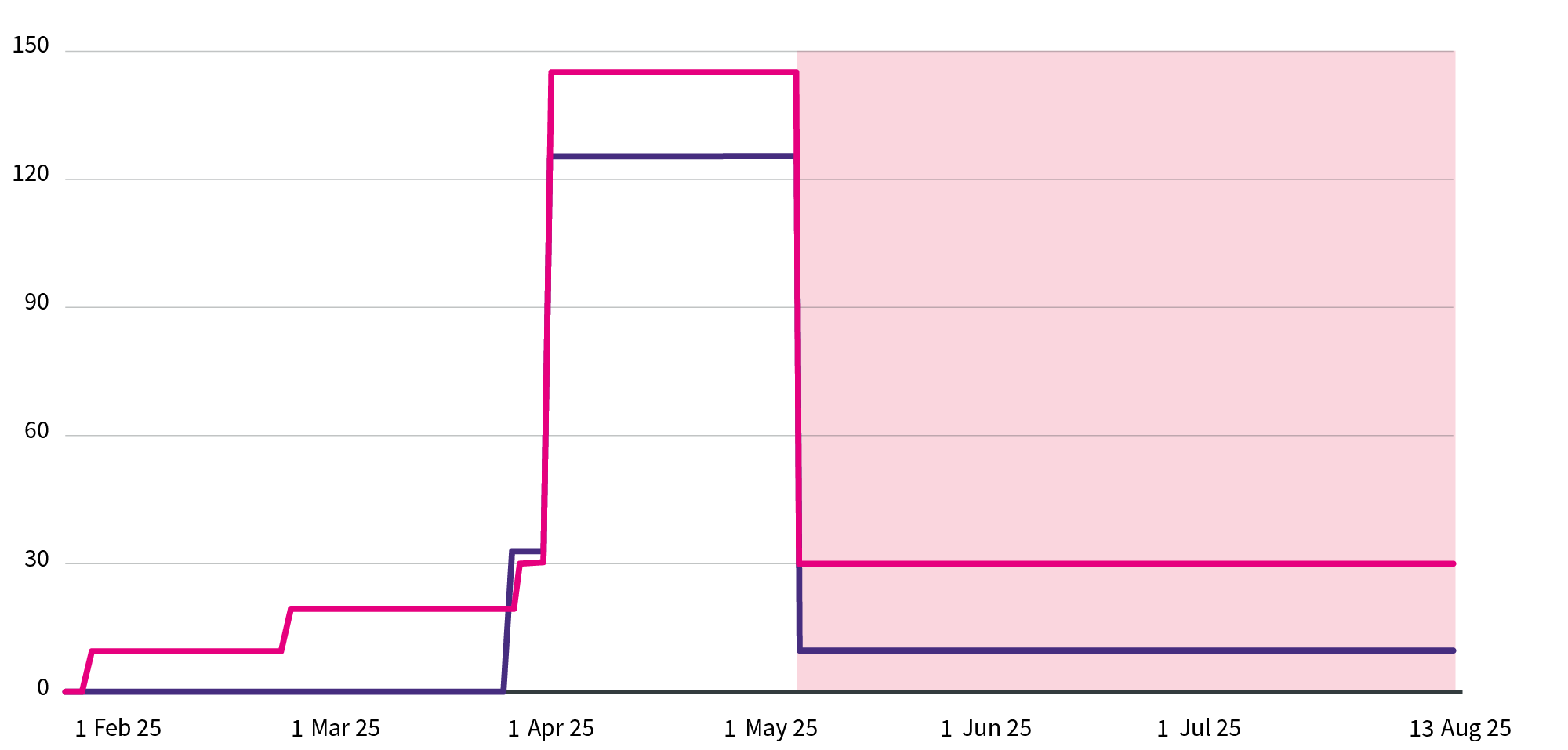

A de-escalation, but tariffs remain at high levels

Additional tariffs between the US and China

ꟷ Chinese additional tariff

ꟷ US additional tariff

■ 90 day pause

Source: The Tax Foundation, CNN

What happens next?

The Trump government has rowed back from its aggressive tariff stance, in response to pressure from falling US equity and Treasury bond markets. So called ‘trade hawks’ who were in favour of higher tariffs have taken a step back, allowing Treasury Secretary Scott Bessent to offer a more moderate approach. Trade negotiations are ongoing with many countries, kicked off by a deal with the UK, in order to beat the deadline in July.

Meanwhile, the US Senate has approved the president’s “big beautiful” tax bill. This involves tax cuts, often without a counterbalancing reduction in spending, which could potentially cause a $3.3 trillion jump in US government debt by 2037. Moody’s, the debt rating agency, responded by cutting the sovereign credit rating of the US economy, which has lost its AAA status.

As for the economic data, the US CPI inflation rate slipped back to 2.3% in April, its lowest reading since early 2021, suggesting the full impact of higher tariffs on US imports has yet to be felt. Future readings for inflation and GDP growth will be closely watched.

AXA IM Select view

We maintain our defensive stance. Despite a strong rebound in equity markets, largely discounting the Liberation Day events, valuation levels seem relatively high given the existing risks. Although tariff risks might have diminished, or simply been postponed, we anticipate companies’ guidance on future earnings will remain cautious.

Markets must recognise that tariffs are unlikely to be reduced to zero, although on the positive side, large scale tax cutting programmes look likely be introduced. We are not forecasting a US recession at this stage.

We maintain a cautious stance on global equities. We expect the US dollar will continue to weaken, as the currency becomes part of the toolbox for trade negotiations.

We continue to prefer eurozone government bonds over cash, as valuations remain attractive. We expect the European Central Bank to cut interest rates, potentially as low as 1% by year end. This will help with infrastructure investment, which is a key objective in Germany.

We are sticking with a neutral position on corporate bonds. The risk of default could rise if the economic outlook weakens further, but the higher levels of interest offered by these bonds remain attractive.

We will continue to hold some cash as ‘dry powder’ in this volatile environment. This might allow us to add to cyclical assets like corporate debt or equities, should valuations become more attractive or if we see meaningful improvement in global growth and inflation.