You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 18 November 2021 | Retirement

When planning for retirement, it’s important for any investor to think about their retirement goals and how long they have to meet them. Committing to a long-term investment strategy when planning for retirement could help avoid making impulsive decisions and ultimately, mistakes. Jumping in and out of the market quickly can be much riskier than sitting back and dealing with the highs and lows of the stock market with a relaxed perspective.

The longer the time to retirement, the higher the risk a portfolio can withstand. Though there will be volatility, stocks have historically outperformed other investments, such as bonds, over long time periods – with the term ‘long’ meaning at least 10 years.

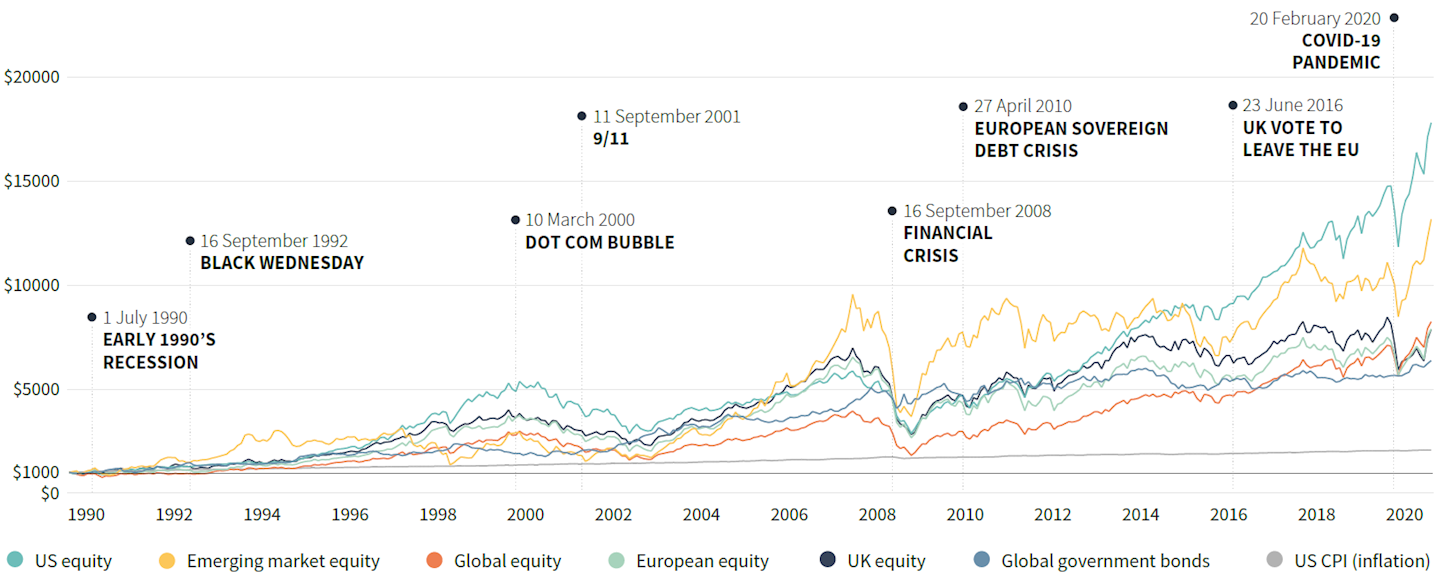

Over the years, there have been many events that have had significant impacts on financial markets, from Black Wednesday in 1992, the more recent financial crisis in 2008 to the impact of Covid-19.

Source: Morningstar, as at 31 December 2020.

Source: Morningstar, as at 31 December 2020.

However, as can be seen from the chart above, the long-term trend for market performance has continued to remain positive. If you are investing for retirement, while you will experience market dips and volatility from time to time, history has shown us that these events won’t stop the long-term positive performance of markets.

It’s important to remember there are no guarantees, and past performance is not a reliable guide to future performance.

Find out more about long-term investing by downloading our guide below.