You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 04 November 2024 | Investments

-0.6%S&P 500 |

-3.5%EURO STOXX 50 |

-1.5%FTSE 100 |

3.7%CAC 40 |

-1.3%DAX |

-2.0%BEL 20 |

0.5%FTSE MIB |

-1.7%IBEX 35 |

1.9%TOPIX |

| Source: Bloomberg 31.10.2024, returns in local currency |

Geopolitics

Polling margins are razor thin between the two candidates in the US presidential election. Seven ‘swing’ states, such as Pennsylvania and Georgia, will likely decide the outcome. Little wonder they have been hit by a $1 billion advertising blitz. But the odds of a Trump victory jumped on the betting platforms, reviving the ‘Trump trade’ in financial markets. The dollar strengthened and Treasury bond yields rose, as the Republicans’ plans for higher tariffs and lower taxes read as inflationary. Meanwhile, the Justice Department warned Elon Musk, a vocal Trump supporter, that his $1 million daily sweepstakes, only open to registered voters in the swing states, might violate federal law.

Government stimulus

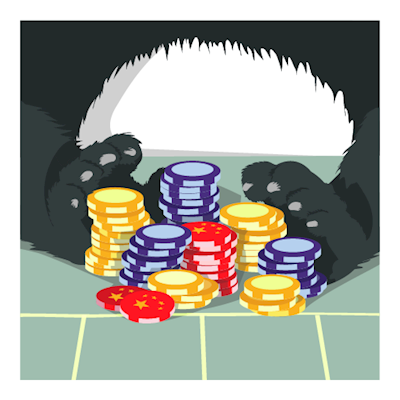

After the initial ‘combination punch’ of government stimulus, involving interest rate cuts and unprecedented stock market support, the Chinese finance ministry followed up two weeks later with stimulus for the property sector. Plans include bailing out local governments, recapitalising large banks and buying millions of unsold apartments. As yet there are few details of any fiscal stimulus, although that could come. The ultimate aim is to keep economic growth on track, most urgently the 5% GDP target for 2024. Trump tariffs of 60% on imports from China could be looming, even as the EU confirmed tariffs of up to 35% on imports of Chinese EVs.

Technology

Tesla launched the ‘Cybercab’ robotaxi, a self-driving two seater without steering wheel or pedals, slated to enter production by 2027 with a price tag below $30,000. Founder Elon Musk predicted the company’s market cap could top $5 trillion, seven times the current level, when the growth prospects for autonomous driving and the AI (artificial intelligence) which guides it are properly valued. The market had other views, however, and the share price fell 12%, as investors complained of an “underwhelming” lack of further detail. Tesla later bounced sharply after Q3 numbers and Musk’s forecast of 20-30% revenue growth for 2025, but still languishes around half its 2021 peak.

Responsible investing

Princeton University reversed rules, adopted just two years ago, banning fossil fuel companies from funding academic research. Faculty members will now be able to accept funding from the likes of oil majors ConocoPhillips and ExxonMobil, provided the project is focused on “the amelioration of the environmental harms of carbon emissions”. Elsewhere, shares of US and European hydrogen companies fell sharply, as lacklustre demand and regulatory uncertainties dampened investor interest in the gas as a low carbon alternative to fossil fuels. Overall, the prospect of a Trump presidency might change the outlook for the ESG sector.