You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 03 September 2024 | Investments

2.3%S&P 500 |

1.7%EURO STOXX 50 |

0.1%FTSE 100 |

1.3%CAC 40 |

2.2%DAX |

1.3%BEL 20 |

1.8%FTSE MIB |

3.0%IBEX 35 |

-2.9%TOPIX |

| Source: Bloomberg 31.08.2024, returns in local currency |

Markets

Markets were priced to perfection. But they were also jittery, as Q2 earnings season and the September Fed meeting loomed. A rate hike from the Bank of Japan, as well as somewhat imperfect tech sector results, triggered an early August correction. Volatility soared, with the Vix index briefly touching pandemic highs, before dropping sharply. The abrupt falls were followed by the longest streak of global market gains so far this year. An indication of persistent nervousness was the performance of gold, which topped its all time high, making a gold bar worth over $1 million.

Geopolitics

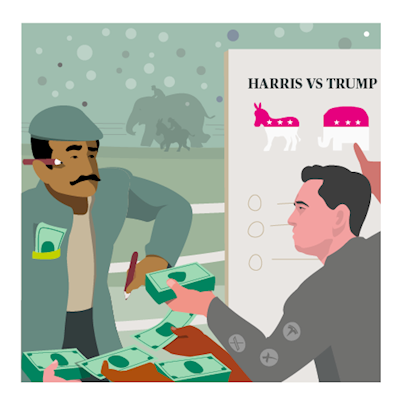

Vice President Kamala Harris was confirmed as presidential nominee at the Democratic Party Convention. Momentum gathered behind her campaign, which has raised $540m since President Biden pulled out of the race. Harris edged slightly ahead of Donald Trump in popular polls, although details of her economic plan were met with some scepticism. Plans to ban ‘price gouging’ in the food sector, also known as ‘greedflation,’ failed to land. Her promise to raise corporation tax to 28% from the current level of 21% sparked Republican outrage. In contrast, Donald Trump has vowed to slash the tax rate to 15%.

Central banks

The pace and scale of Fed rate cuts was at the front of central bankers’ minds, as they gathered for the annual Jackson Hole summit. Chair Jay Powell stated that "the time has come for policy to adjust". While the betting odds of a 25 bps cut in September hit 100%, the odds of a 50 bps cut climbed above 25%. And yet the Fed is still keenly data dependent. After the gyrations of early August, in part sparked by fears of US recession, the markets will be laser focused on US jobs data in early September.

Responsible investing

President Biden’s Inflation Reduction Act (IRA) continues to spur investment in US manufacturing and jobs, as companies look to ramp up battery and solar panel production. The fact that many of the new jobs are in the ‘Rust Belt’, a traditional stronghold for Republican supporters, poses a conundrum for Donald Trump. He has promised to repeal the bill if re-elected in November. With US$400 billion in state subsidies for renewable energy technologies, the IRA has been hailed as the most important G7 policy move so far in the battle against climate change.