You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 02 August 2022 | Investments

QUICK LOOK

The Markets

9.1%S&P 500 |

7.3%EURO STOXX 50 |

3.5%FTSE 100 |

8.9%CAC 40 |

5.5%DAX 30 |

3.1%BEL 20 |

5.2%FTSE MIB |

0.7%IBEX 35 |

3.7%TOPIX |

| Source: Bloomberg 29.07.2022 |

Electric dreams?

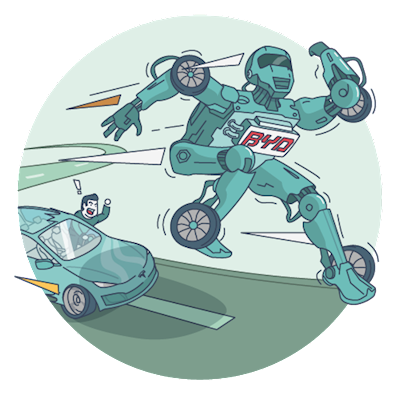

Although little known in global markets, Chinese auto maker BYD has taken the World No 1 slot for sales of electric vehicles. The company, whose name stands for ‘Build Your Dreams’, has leapfrogged the ambitions of established car manufacturers such as VW or Ford to beat Tesla into second place. Meanwhile, Tesla founder Elon Musk is locked in legal battle with Twitter, after withdrawing his takeover bid. The social networking giant alleges he treated the transaction agreed in April as an ‘elaborate joke’. Perhaps not so much the $1 billion fee now demanded in recompense.

Green conviction

The oil price settled just above $100 a barrel. That’s well below highs reached after the invasion of Ukraine, but still 40% more than a year ago. This jump prompted the CEO of Shell to raise forecasts for both demand and prices. And to revise up the value of the oil major’s exploration assets, written down during the pandemic. He hails the energy price spike, and the soaring inflation that followed, as the wake-up call the world needs. Policy makers could now switch from ‘sufficient ambition’ to ‘sufficient conviction’ in their energy transition plans.

Guidance abandoned

As inflation surged ever higher, hitting multi-decade highs, major central banks leapt into action. The European Central Bank (ECB), the US Federal Reserve and the Bank of Canada delivered blow out interest rate hikes, outstripping consensus expectations. Equity and bond markets rallied, reflecting confidence that such decisive action might tame inflation. Recession moved in as the next worry on the horizon, as the International Monetary Fund slashed growth forecasts. Meanwhile, central banks are abandoning market guidance, preferring to be data dependent. Every meeting is a live meeting, according to the ECB.