You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 02 March 2022 | Investments

QUICK LOOK

The Markets

-3.1%S&P 500 |

-6.0%EURO STOXX 50 |

-0.1%FTSE 100 |

-4.9%CAC 40 |

-6.5%DAX 30 |

-1.4%BEL 20 |

-5.2%FTSE MIB |

-1.6%IBEX 35 |

-0.5%TOPIX |

| Source: Bloomberg 28.02.2022 |

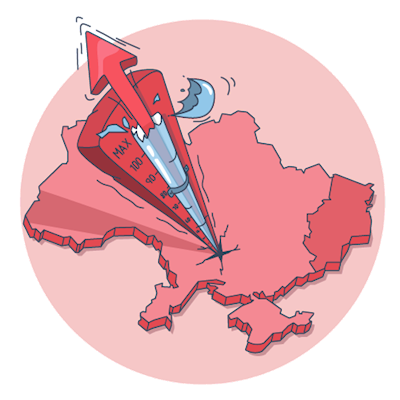

Geopolitical hot spot

Despite intensified diplomatic efforts, a military invasion of Ukraine was launched by Russia. The first wave of sanctions, initially mainly financial, were imposed on Russia by NATO member states. Markets were forced to contend with two sources of uncertainty- not only macroeconomic, but also geopolitical. It’s little wonder that volatility levels have risen sharply. Meanwhile in the commodity markets, the price of oil breached $100 per barrel, as Russia is the world’s second largest oil producer. And gold has been in greater demand, proving its worth as a safe haven asset.

EV charging boost

President Biden has promised $5 billion investment in EV charging infrastructure. Potential US buyers of EVs are being held back by battery life concerns and scarcity of charging points. It seems they are largely found in only four states, with California top of that list. Meanwhile, as gasoline prices hit a seven year high, the president is in a bind. A self-confessed ‘car guy’, Biden recognises that soaring pump prices play badly with voters. Yet plans to scrap federal gasoline taxes smack of subsidising fossil fuels. That’s an awkward situation for any environmentalist.

Off the charts

The dramatic jump in prices of raw materials from aluminium to food ingredients is making life challenging for producers of consumer goods. So much so that the models used to predict end prices, which are ultimately drivers of demand, have been ripped up. The situation is described as ‘crazy’ and has certainly not been seen for many a decade. Manufacturers must gauge whether to pass on cost price hikes, or grin and bear it. Taking a short term hit to margins, while hoping the inflationary surge will prove transitory after all.