You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 16 September 2024 | Investments

The popularity of passive investment funds, typically exchange listed index trackers, has grown over the past decades. These funds offer investors simple and straightforward access to financial markets at a low level of fees. Research by AXA IM Select shows that the exclusive use of passive funds as an investment tool could lead to missed opportunities with passives working best alongside actives, and when used actively. There are certain periods when active funds, run by a fund manager making specific investment selections, outperform their benchmarks. In other words, within the broad investment universe, there is a time and a space for both active and passive funds.

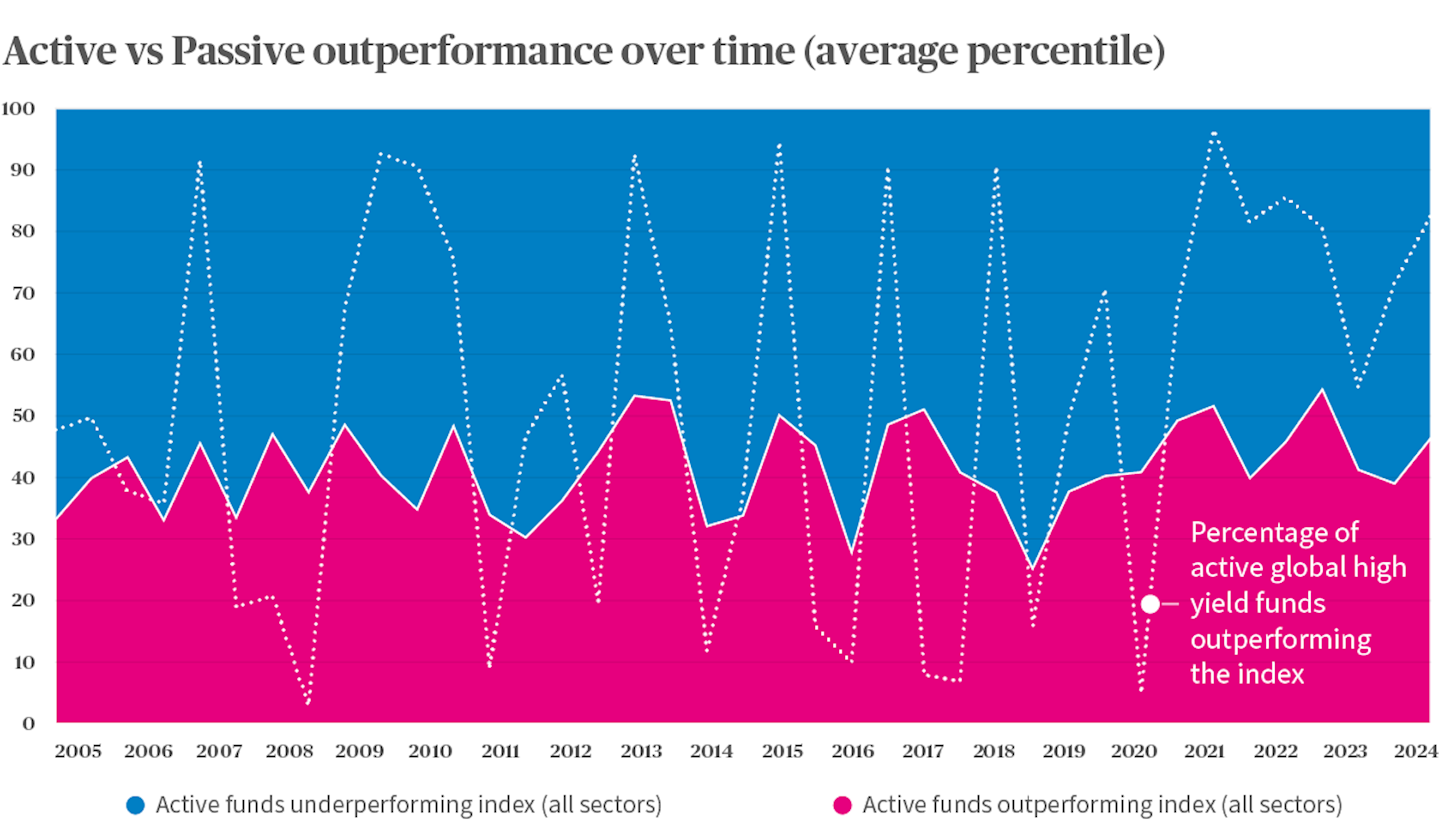

There is also an active choice involved in the selection of either active or passive funds. Or indeed in blending a combination of both types of fund. This active choice can be exploited to full effect by multi-manager funds. The research undertaken by AXA IM Select has shown that at specific inflection points in the market, active funds will outperform their passive counterparts within a range of sectors. This can represent an investment opportunity for a blended portfolio. Take as an example the Global High Yield Bonds sector (Global HY), comprising both active and passive funds. The chart below shows the comparative performance between active and passive funds over time based on the average performance of all funds in the universe. (The pink area represents when active funds outperformed the index and the blue area shows when passive funds outperformed active funds). The dotted white line on the chart indicates the performance of the Global HY only. Periods where active Global HY funds outperform their passive counterparts are shown by the rising dotted white line.

The period from 2008 until 2009 was a time of significant monetary support, when QE (quantitative easing) was introduced to support the financial system. As interest rates were slashed by the central banks, yields were kept artificially low in some parts of the high yield bond market, meaning these prices rose, while the worst hit bond issuers defaulted. Active fund managers were able to cherry pick the Global HY universe, looking for star performers. A passive Global HY fund could not have been so selective.

Another marked period of outperformance for active funds is evident in the last couple years. The inflection point here appears to be the switch in the interest rate cycle in 2022, as central banks hiked rates in order to bear down on inflation. This threw up investment opportunities, which an active manager could seize.

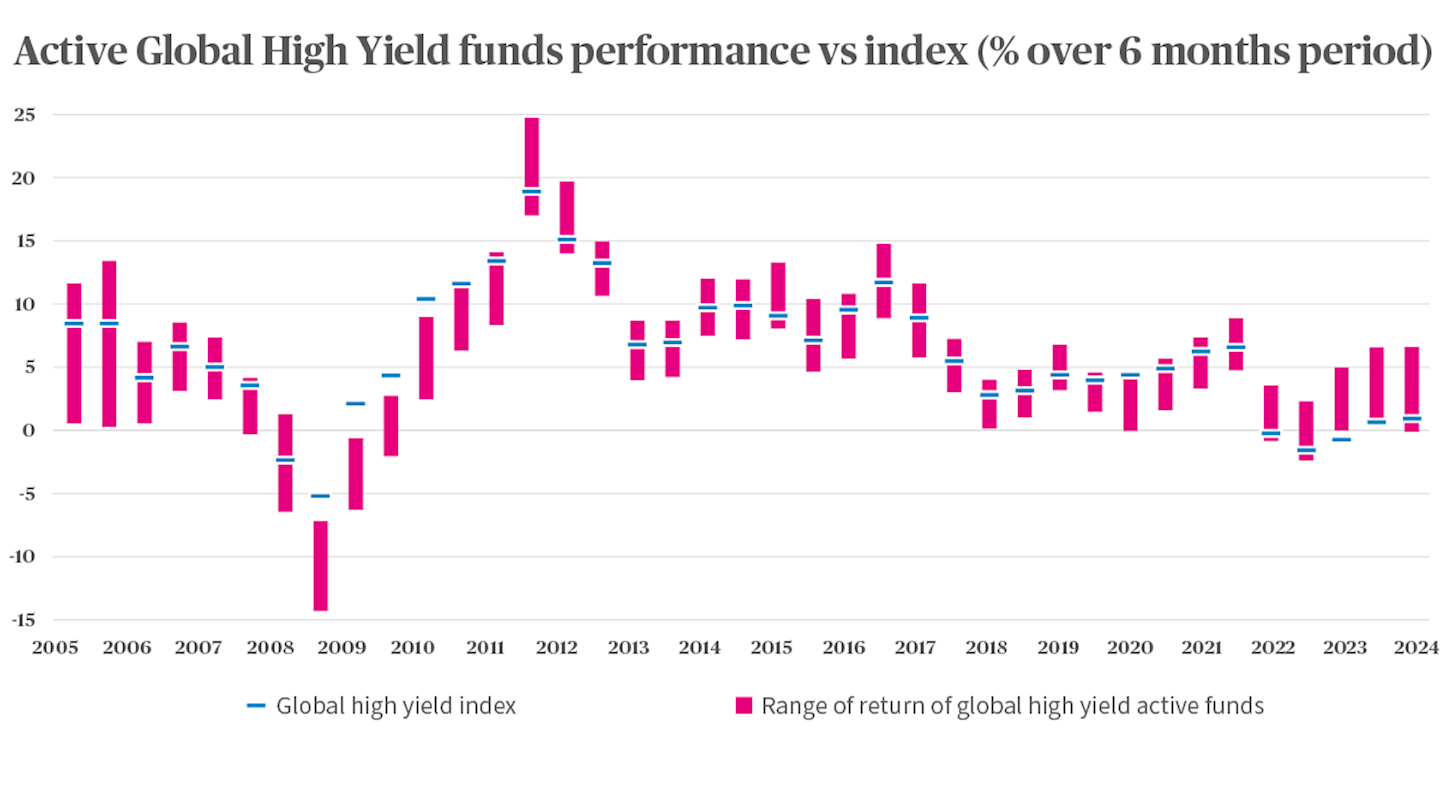

A second consideration has become evident from our research. While active funds within an asset class such as Global HY might outperform at these inflection points, there can be considerable dispersion among the fund managers within the outperforming sector. The chart below shows the broad range of performance between the top and bottom ranked fund managers within the Global HY sector, with the performance of the Global HY index also marked. This highlights that even in periods where active funds are outperforming the index in the main, such as 2022 and 2023, you still need to select the right active managers. This is where expert fund selectors such as multi-managers can add value.

Choosing a top quartile fund manager within an outperforming sector will naturally add outperformance, or alpha, to an investment. In other words, the selection of a specific fund can secure valuable extra returns. The expertise offered by a multi-manager approach gives the ability to allocate investments across both active and passive funds. At AXA-IM Select we aim for a blend of both active and passive funds within a portfolio, taking advantage of market inflection points and best in class fund managers, while also aiming to invest in a balanced and cost-effective way. Making investing passively an active decision.