You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 28 July 2021 | ESG

As an industry we currently use many different terms and phrases to describe products and approaches that, taken together, attempt to do very similar things – though in slightly different ways.

In the absence of consistent industry standards, this labelling and relabelling, could become a source of confusion, making retail investors less inclined to change their investment behaviours. Our research finds that none of the commonly used industry terms are universally recognised by a convincing majority of investors.

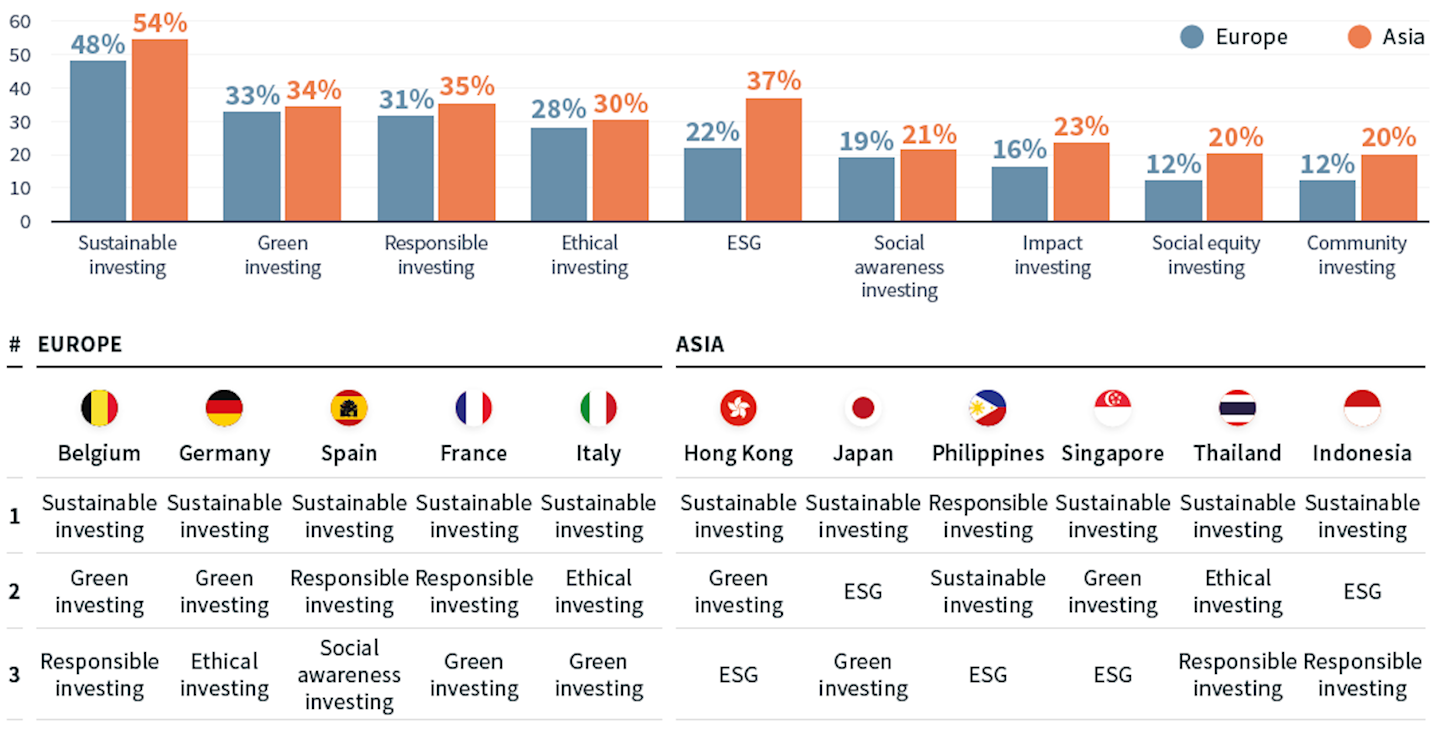

- ‘Sustainable investing’ is the most recognised term (by 48% in Europe and 54% in Asia respectively).

- Only one-third recognise the term ‘green investing’ or ‘responsible investing’.

- The term ‘ESG’ which is commonly used in the financial services industry is only recognised by one in five (22%) investors in Europe and one-third in Asia (36%).

Q. The following terms and phrases are sometimes used to describe investments which focus on the social, ethical and environmental impact of the investment. Which ones have you heard of? (Investors only)

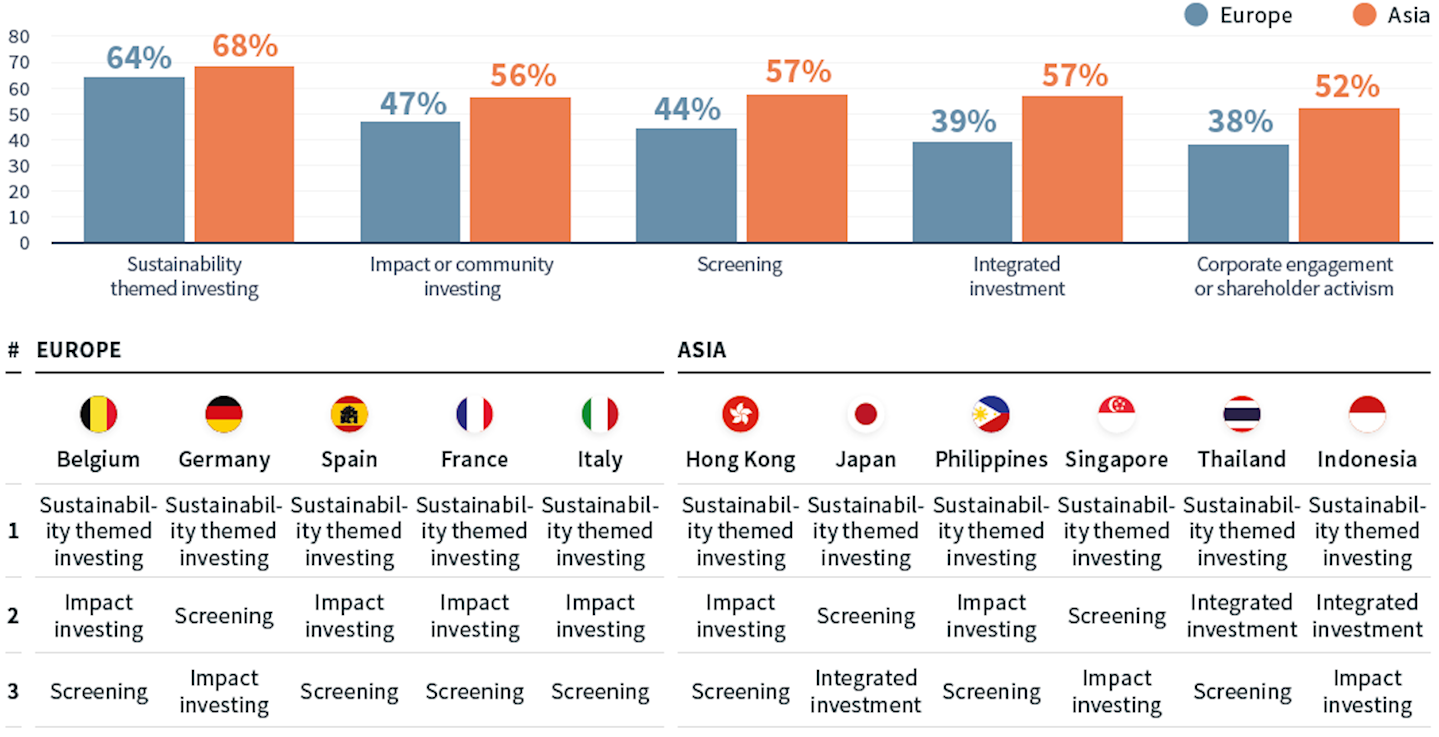

Retail investors are, however, seemingly more aware of the underlying concepts of these approaches when given an explanation of their meaning. Awareness of Impact Investing, for example, climbs from just 16% to 47% in Europe (and from 22% up to 54% in Asia) when a description of what impact investing means was provided alongside.

Clearly, we need to adopt a clear, simple and consistent approach to how we create, label and describe investment ESG products for retail investors – both to ensure that investors are treated fairly and to avoid funds being inaccurately labelled or described.

Q. Which of the following ESG approaches had you heard of before today? (Investors only) [1]

While different regions wrestle to establish a common taxonomy and framework for sustainable investing (often positioned for the benefit of institutional, not end-investor audiences), we must not miss the window of opportunity to create clearer language for retail investors. Establishing clear, simple, and common terminology will therefore be key in helping to shape and inform investor decisions and ensure that the market attracts the widest possible audience as it continues to expand.

See the full results of our ESG investing research here

[1]Full terms shown in survey: