You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 13 May 2021 | ESG

Written by Patrick Zweifel, Chief Economist at Pictet Asset Management

Inflation fears are rumbling through financial markets again. Unprecedented fiscal and monetary stimulus to contain the fallout from the Covid pandemic has investors worried that the multi-decade fall in inflationary pressures might finally be about to turn. They key question facing them is how to prepare.

In part, history suggests the outlook for markets depends on what the inflationary backdrop is likely to be.

The prospect of a sharp pick-up in inflationary pressures is beginning to concern investors. Our historical analysis sheds light on how stocks, bonds and other asset classes behave during periods when inflation takes hold.

Patrick Zweifel, Chief Economist at Pictet Asset Management

The risk of a strong rise in US inflation is probably at its highest for at least 15 years. Lockdowns designed to rein in the pandemic have caused supply bottlenecks, leading to a rise in commodity prices and those of other production inputs; delivery times have also lengthened, further reducing availability of goods.

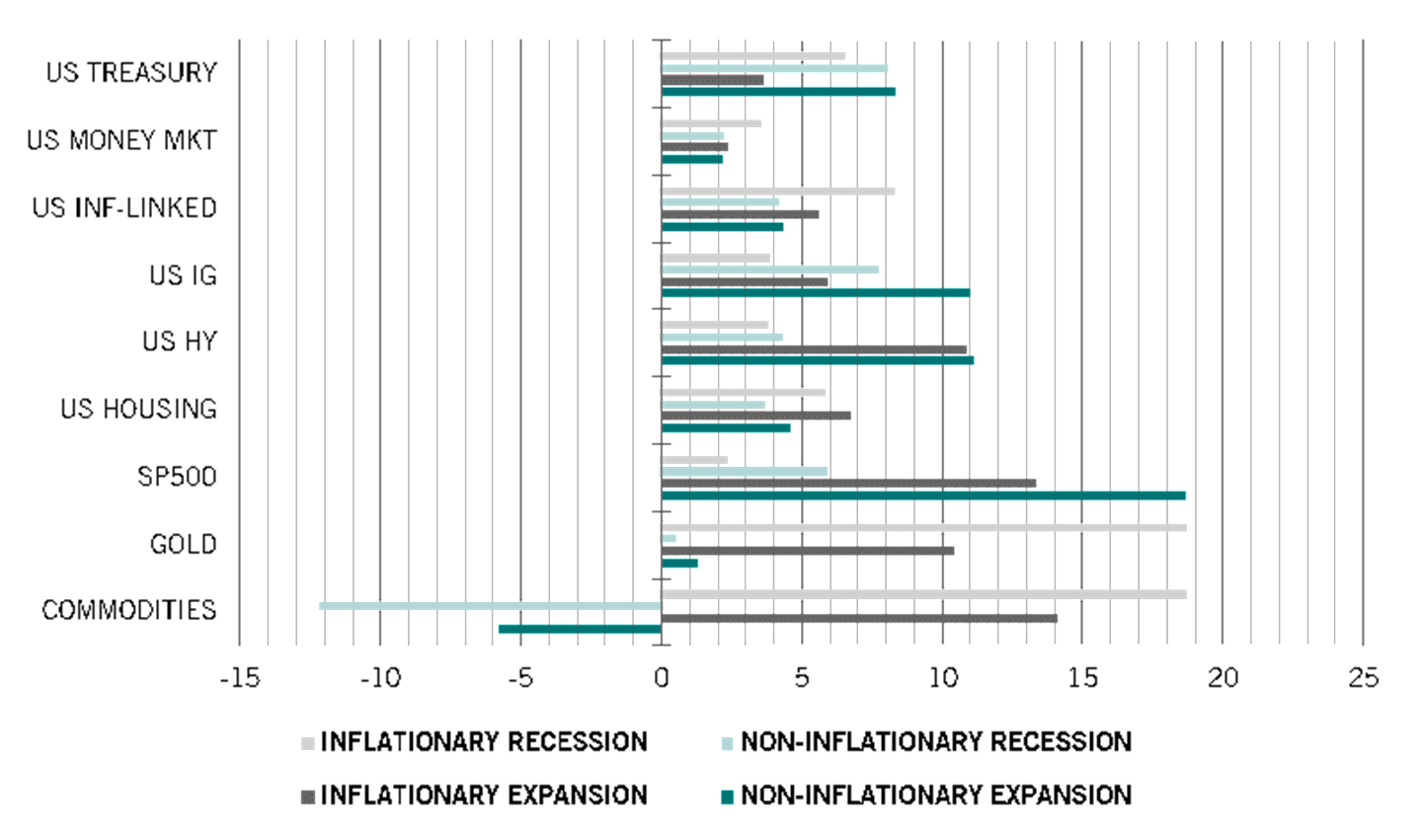

Fig. 1 - A mixed bag

Correlation between asset classes’ returns and current US growth and inflation since 1950*

Source: Pictet Asset Management, CEIC, Datastream. For details of dates see Fig. 2.

Base effects will also be significant. Oil prices collapsed a year ago – the prices of some oil contracts went negative briefly in 2020 – and their subsequent recovery will push annual headline inflation measures above 3 per cent in the second quarter.

These factors have fed through to inflation worries. Long-run inflation expectations, implied by the 10-year breakeven inflation rate, have risen to 2.3 per cent, their highest since July 2014. Household inflation expectations for the coming year have also jumped, up 1.2 percentage points to 3.3 per cent and their 5-year expectations have climbed to 2.7 per cent.

Supply-driven inflationary pressures should ease with the opening of the economy as the pandemic is brought under control. But at the same time, demand is set to jump as consumers start to spend their stimulus cheques, not least on long-shut services.

If inflation is on its way up, how investors ought to react will depend on the wider state of the economy and business conditions.

We took a look at one year total returns of nine asset class indices – commodities, gold, S&P 500, US Treasury bonds, US high yield credit, investment grade credit, Treasury inflation protected securities (TIPS), money markets and housing – relative to what was happening to US inflation and economic growth since 1950.

Fig. 2 - For every season there's an asset

Average year on year returns for asset classes under different US economic environments*, %

Source: Pictet Asset Management, CEIC, Datastream.

*Date ranges for data are as follows: US Treasury from 01.01.1979 to 31.12.2020; Gold from 01.01.1969 to 31.12.2020; US inflation-linked from 01.03.1998 to 31.12.2020; US investment grade from 01.01.1974 to 31.12.2020; Commodities from 01.12.1970 to 31.12.2020; US high yield from 01.09.1987 to 31.12.2020; US money market from 01.01.1996 to 31.12.2020; S&P 500 from 01.01.1950 to 31.12.2020; US housing from 01.03.1971 to 31.12.2020.

In general, we found a negative correlation between inflation and US Treasuries, stocks and investment-grade credit, and a positive correlation with the six other asset classes.

Although money markets are positively correlated with inflation, their real returns during periods of high and rising prices are slightly negative. By contrast, TIPS, housing, commodities and gold all post positive returns during inflationary periods, in double digits for the latter two. What’s more, commodities, real estate and gold continue to show a positive correlation to inflation even with a lag, which is to say their future returns rise and fall with current inflation.

Investment returns move in the same direction as economic growth for all asset classes except Treasury bonds, TIPS and gold, with Treasuries showing the largest negative correlation. Stocks and high yield bonds show the strongest correlation with economic growth, though housing and money markets also move in the same direction.

As the 1970s made very clear, though, rising inflation doesn’t always coincide with economic growth. In which case, investors need to know what happens to assets under different inflationary and growth regimes.

We classified periods based on whether US quarterly GDP growth was above or below its 7-year moving average, and inflation by whether inflation was above a 2 percent annual rate and rising or, alternatively, below 2 per cent or declining.

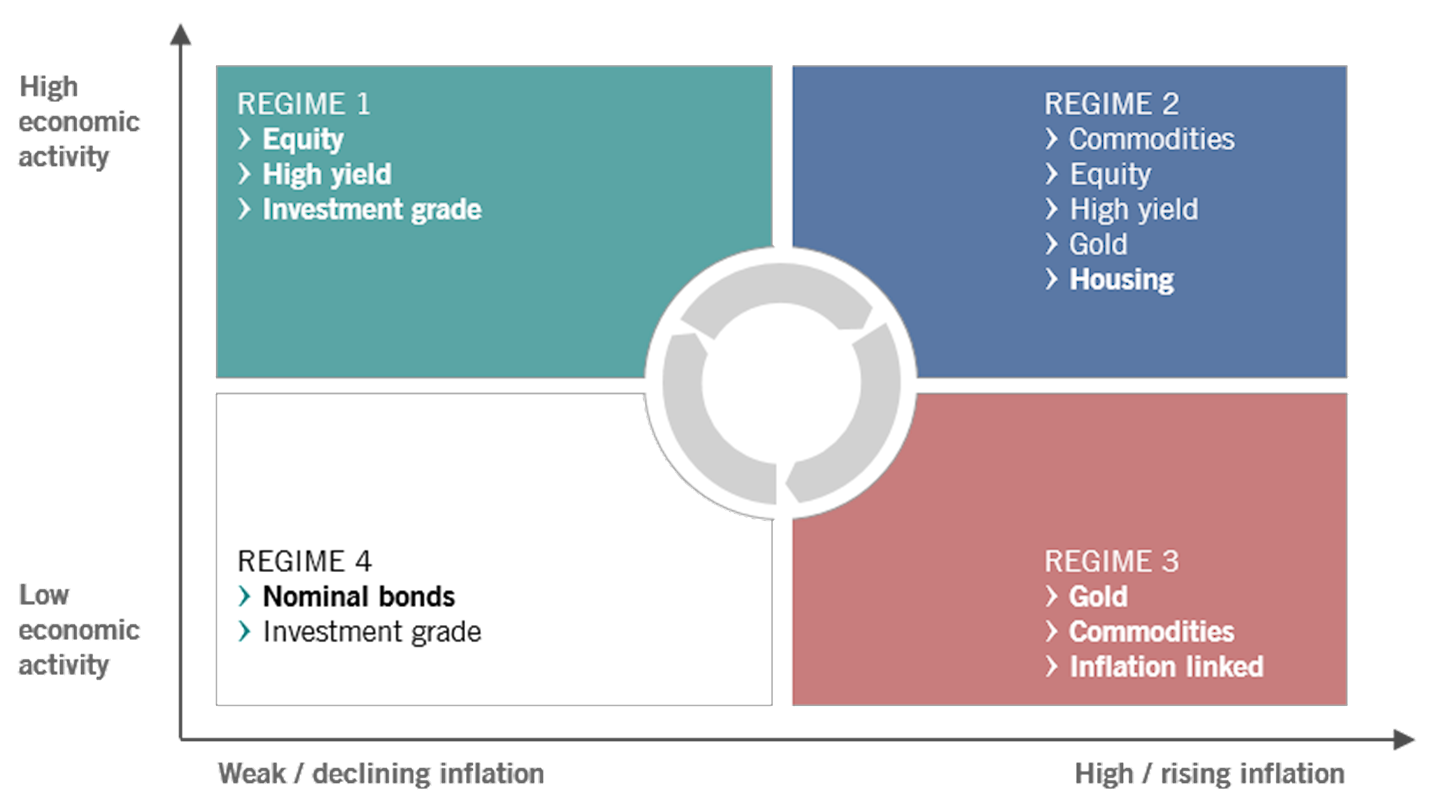

We found that in benign environments of low inflation but strong growth, the best performers were riskier assets: stocks, high yield and investment grade credit, with average annual returns of 19 per cent for the first and 11 per cent for the latter two. Gold and commodities, which are typically good hedges against inflation, were the worst performers under that scenario.

In periods of rising inflation and growth – which seems the most likely outcome for the coming quarters – commodities generated 14 per cent annual returns, the S&P 500 was up 13 per cent, high yield and gold up around 11 per cent and housing up 7 per cent. Indeed, this is the second-best economic environment for both stocks and high yield credit, which suggests growth is a more important factor here than inflation. By contrast, TIPS, Treasuries and money markets all fared badly in that environment.

Fig. 3 - What does best when

Best performing* asset classes under each US economic environment

*Based on average annual year on year returns under four US economic scenarios. Source: Pictet Asset Management, CEIC, Datastream.

Date ranges for data are as follows: US Treasury from 01.01.1979 to 31.12.2020; Gold from 01.01.1969 to 31.12.2020; US inflation-linked from 01.03.1998 to 31.12.2020; US investment grade from 01.01.1974 to 31.12.2020; Commodities from 01.12.1970 to 31.12.2020; US high yield from 01.09.1987 to 31.12.2020; US money market from 01.01.1996 to 31.12.2020; S&P 500 from 01.01.1950 to 31.12.2020; US housing from 01.03.1971 to 31.12.2020.

In those periods when inflation was high and growth low, gold and commodities generated 19 per cent annual returns, TIPS 8 per cent and Treasuries 7 per cent. In those periods, high yield credit, money markets and stocks were the worst performers.

Finally, when inflation and growth were both subdued, Treasury bonds and investment grade credit posted returns of 8 per cent, while stocks were up 6 per cent. Gold and commodities were the worst performers under these conditions.

Interestingly, adjusting those returns for risk doesn’t alter these outcomes materially – though here we are restricted to using data available since 1998 rather than the full history back to 1950. The only difference of note is that TIPS look more attractive during periods of inflationary expansion on a risk-adjusted basis.

Our analysis of US asset class returns suggests investors have plenty to think about as they parse economic developments. Will inflation take off and become embedded, or are we just looking at a temporary spike after which price pressures will fade back to trends of the past decades? Will the economy snap back and maintain momentum? Will the US Federal Reserve calibrate its monetary policy to suit the real economy? Will the last bout of stimulus trigger overheating?

But whatever the actual outcome, at least history offers some guide to what investors might be able to expect from asset classes.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

This marketing document is issued by Pictet Asset Management. It is neither directed to, nor intended for distribution or use by any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund’s prospectus, the KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet.

This document is used forinformational purposes only and does not constitute, on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund’s prospectus and are not intended to be reproduced in full in this document. Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund’s full documentation or for any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

EU countries: the relevant entity is Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg. Switzerland: the relevant entity is Pictet Asset Management SA , 60 Route des Acacias – 1211 Geneva 73. Hong Kong: this material has not been reviewed by the Securities and Futures Commission or any other regulatory authority. The issuer of this material is Pictet Asset Management (Hong Kong) Limited. Singapore: this material is issued by Pictet Asset Management (Singapore) Pte Ltd. This material is intended only for institutional and accredited investors and it has not been reviewed by the Monetary Authority of Singapore. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957)

is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001. For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in North America to promote the portfolio management services of Pictet.