You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 14 October 2021 | ESG

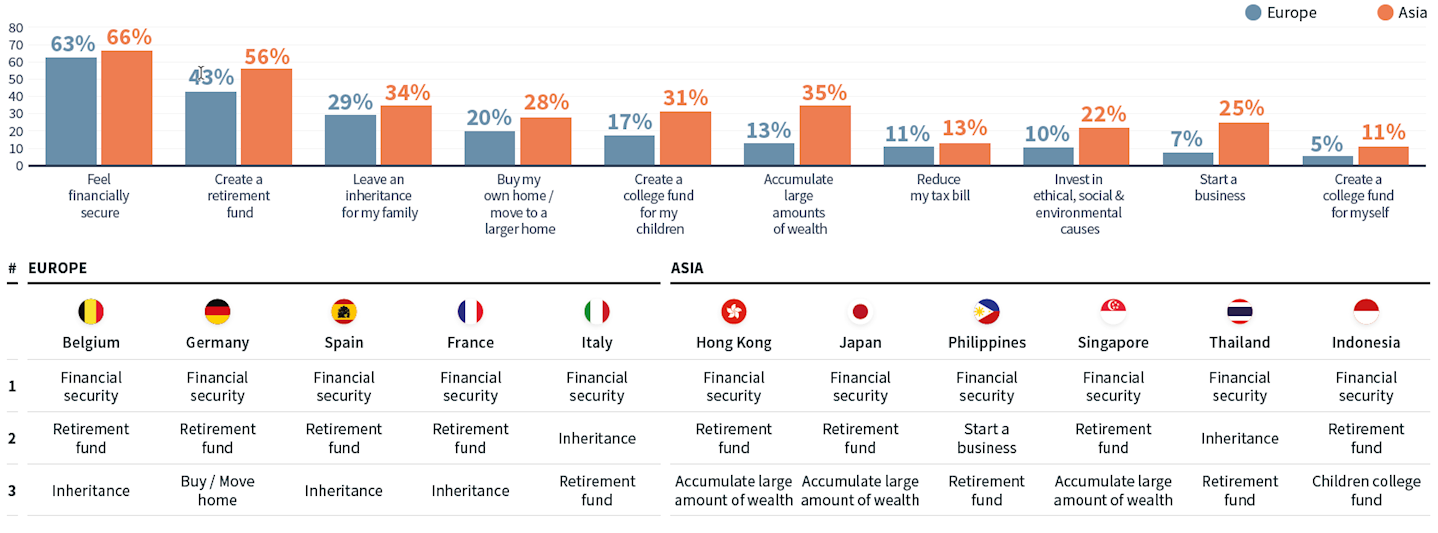

In Architas’ latest research, we asked individuals about their reasons for investing. We found that financial security is the key motivation for around two-thirds of investors in both Europe (63%) and Asia (66%). The second most important goal globally is to create a retirement fund (43% vs. 56% across Europe and Asia respectively). And with the third key goal being a desire to leave an inheritance for family (29% vs. 34% across Europe and Asia respectively), it is clear that most people are investing with long-term goals in mind.

Q: People save and invest for different reasons. What are you currently saving and investing for? (Investors only)

The creation of a retirement fund is likely to become a growing motivation to save or invest for individuals in the future. Since the global financial crisis, countries around the globe have engaged in intense reforms to pension systems, often involving pension programmes funded and managed by the private sector.[1] The past decade has seen a shift in emphasis from the state to the individual to fund retirement income in many parts of the world.

More recently, over the past 18 months, the global pandemic has prompted an unprecedented fiscal response from governments, many of whom offered a broad set of measures, such as job-retention schemes and unemployment benefits to combat the economic impact of Covid-19. However, newly accumulated public debt will add pressure on pension finances already strained by demographic shifts.[2] This will likely accelerate the shift in emphasis from the state to individual for retirement income in years to come.

With these changes taking place it is likely that the awareness, understanding and interest individuals have in their pensions will increase. In parallel, a growing number of people are demanding more from how their money is invested. It is no longer just a discussion of profit, but also purpose. Individuals are no longer content with handing over their savings to an investment manager and turning a blind eye to the types of companies being invested in. The same is true of pension savers.

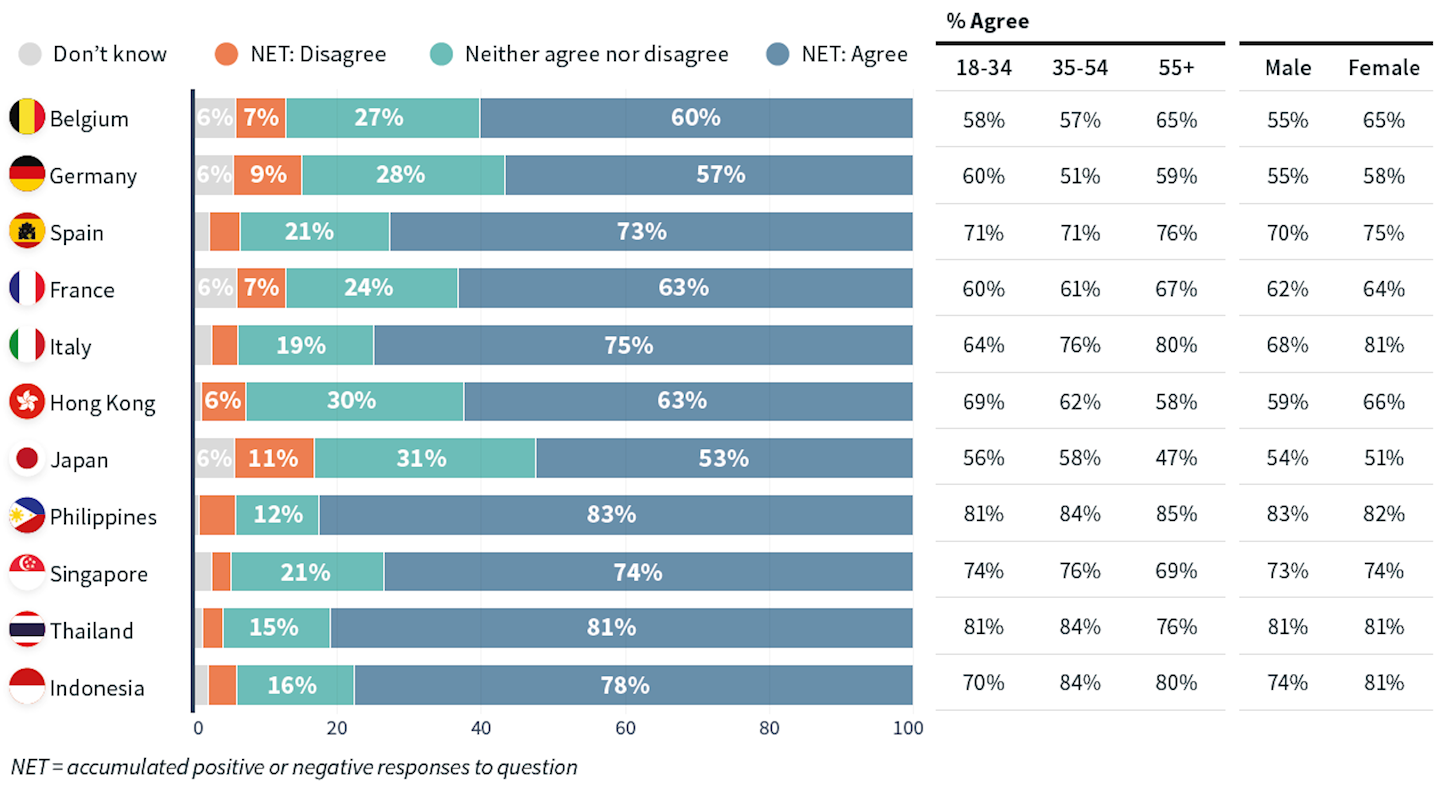

A majority of Europeans agree that their own ethical views should be taken into consideration when making an investment. This peaks at 75% in Italy and is lowest in Germany (57%). This figure is typically even higher across Asian markets, peaking at 83% in the Philippines but lower in Japan (53%).

Q: To what extent do you agree that your own personal ethical views should be taken into consideration if you were to make an investment? (All respondents)

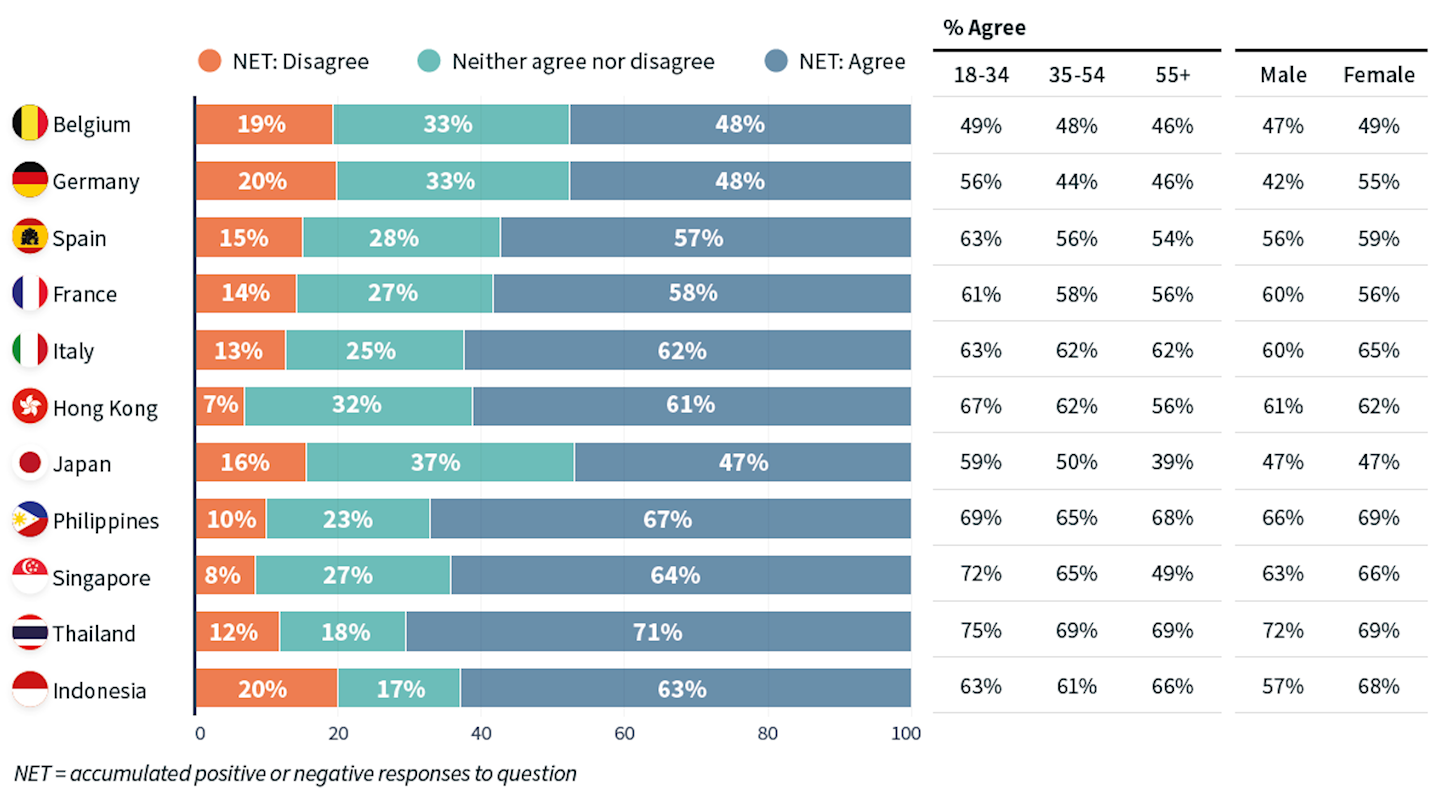

Furthermore, across Europe and Asia over half of pension holders state that they would consider switching their pension elsewhere should they discover their money was being invested in a way that did not reflect their ethical outlook.

Q: Thinking for a moment about pensions you have (workplace pension or a private plan), to what extent would agree with the following… ‘Learning that my provider was investing my money in a way opposed to my ethical viewpoint would prompt me to consider switching provider’ (All respondents with a pension)

This view is more commonly held among young people, suggesting a generational shift is occurring which will shape what people come to expect from their pension provider in the future. While there is a level of inertia in individual behaviour when it comes to switching a pension provider, as the world’s largest institutional investors, pension funds must now deliver an approach that accommodates the ethical views of the savers they are investing on behalf of.

If you would like to see the full results from our study, they can be found here

[1] OECD, Global Pensions statistics, 9th June 2021

[2] OECD, OECD Pensions Outlook 2020, 7th December 2020