You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 15 July 2021 | ESG

At Architas, we are driven by our core purpose to act for human progress by protecting what matters. For us, ‘what matters’ starts with our customers.

Our latest research into the views of 11,000 individual investors and prospective investors in 11 markets across Asia and Europe gives us key insight into perceptions and understanding of ESG investing, the motivations behind why people invest, and how investors would like their hard-earning savings to be invested.

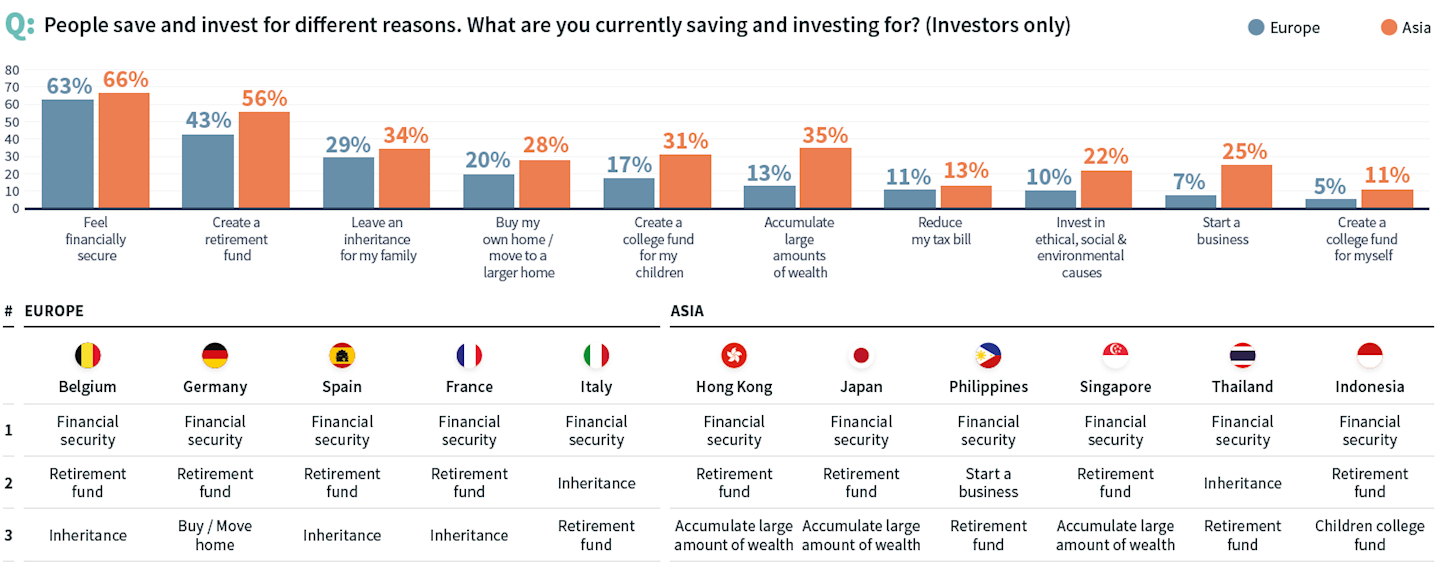

The findings from our research are clear. The top-ranking goal for investing is to ‘achieve financial security’, this was ranked first across all 11 markets surveyed in both Asia and Europe.

66% of Asian investors invest so that they can feel financially secure, the figure in Europe was 63%. In contrast, 56% of Asian investors invest to create a retirement fund which falls further to 43% in Europe. Only three countries chose other motives among their top two – to leave an inheritance was a motive in both Italy and Thailand, whereas those in the Philippines were investing to fund a business start-up.

These findings should come as no surprise. Investors want to feel financially secure and for many that means looking ahead to retirement or making plans to leave a financial legacy to loved ones. The question is, where do environmental, social and governance (ESG) considerations sit in the overall investment equation?

A growing number of people are demanding more from their money. Not just profit, but also purpose. Retail investors are no longer content with handing over their savings to an investment manager and turning a blind eye to the types of companies being invested in. They want to know that their investments are being used for good, or as a minimum are doing no harm.

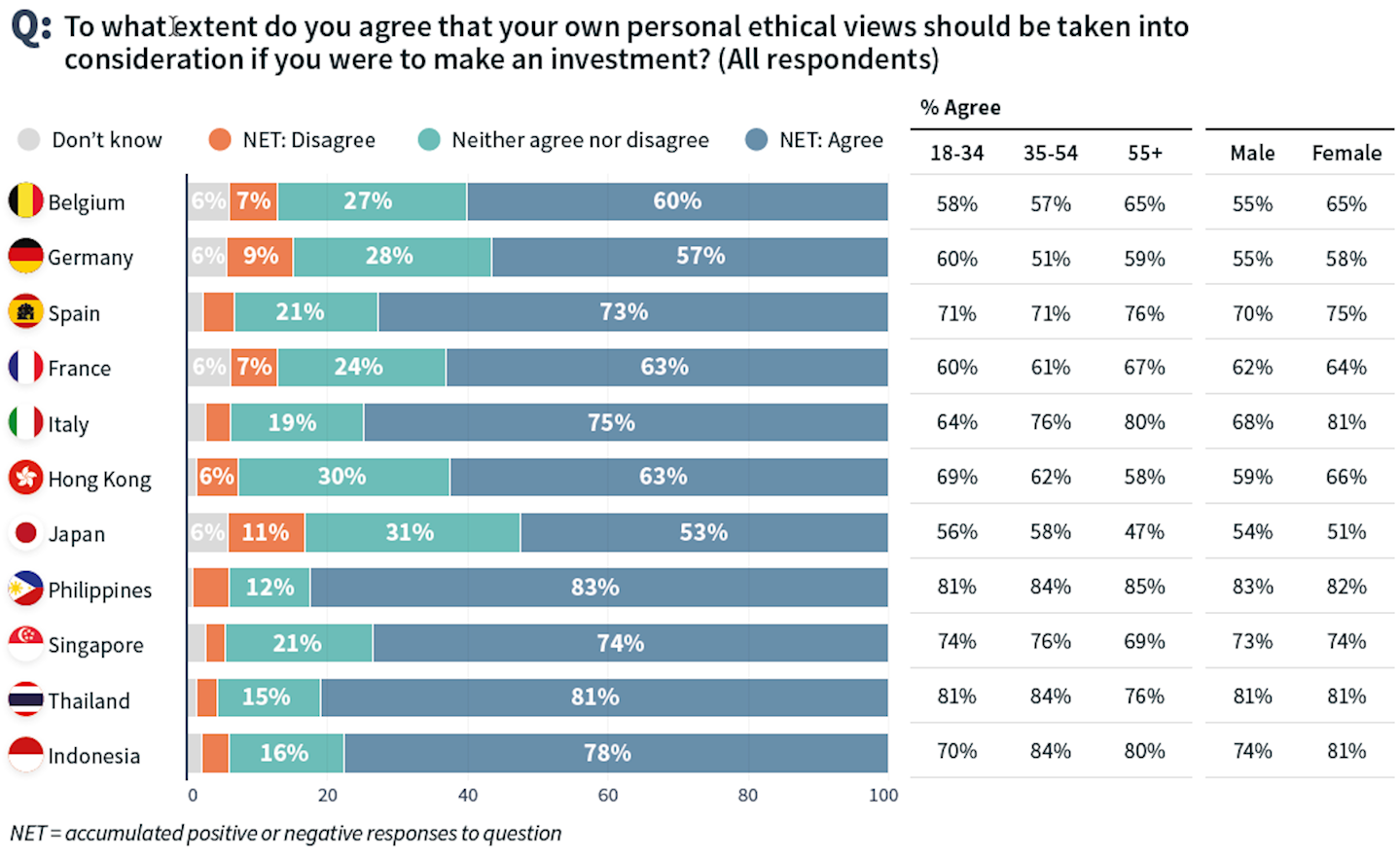

Our research demonstrates that how money is invested is hugely important. Around two-thirds of Europeans agree that their own ethical views should be taken into consideration when making an investment. This peaks at 75% in Italy and is lowest in Germany (57%). This figure also remains high in Asia peaking at 83% in the Philippines but is lower in Japan (53%). Notably however, the number is over half in all markets surveyed across the two key regions. There is a clear consumer mindset favouring a shift towards investments which align with individual moral principles – and this feeling crosses all geographic and cultural borders.

Responsible investing doesn’t mean looking at ‘the financials’ in isolation when you are making an investment. It is a broader approach to look at how the investment is affecting society and the environment. What matters in society and the environment varies depending on personal ethics and views. Reflecting personal ethical views also represents an industry-wide challenge.

A personal ethical viewpoint is by very definition, independent and sensitive. To this end they are difficult to accommodate and standardise within individual product offerings. Investor’s views on the acceptability of different industries and corporate activities vary widely from person to person. It is therefore important for the industry as a whole to consider what investments may or may not be appropriate for an investor based on the individual investors views. Our research explored this idea of acceptability in greater detail and will be the subject of a future article in its own right.

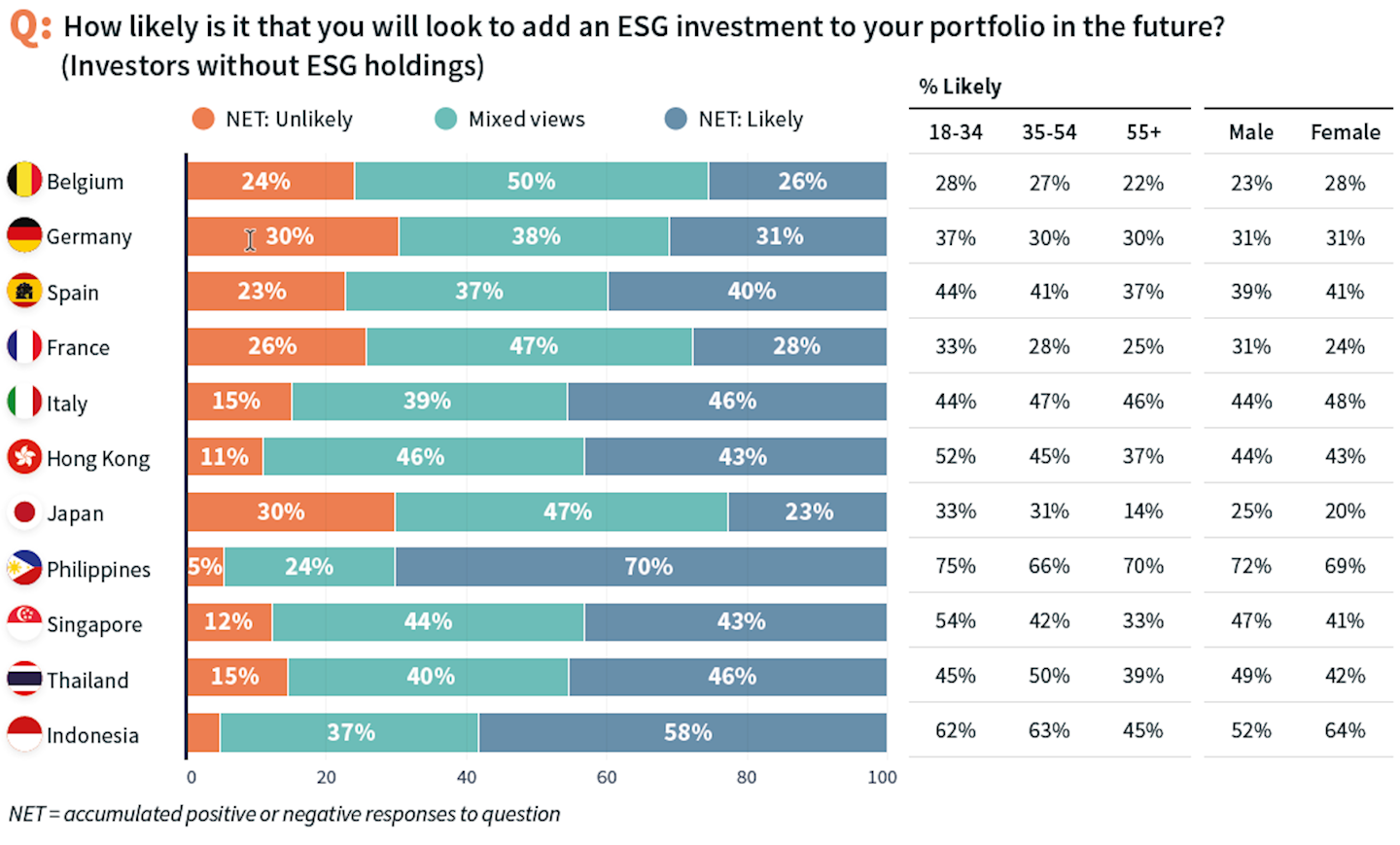

Whatever the challenges, it is clear that we, as an industry, have to work hard to overcome them in order to deliver the type of solutions that our customers demand. And that demand is only going to increase. Indeed, as our research shows, while appetite for ethical or ESG holdings varies widely by country, a significant proportion of investors without such funds are likely to look to add one in the future – with this peaking at 70% in the Philippines and 58% in Indonesia.

As such, we should look to face this challenge head on – because like most challenges, it also gives us a great opportunity.