You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 08 April 2021 | ESG

Written by Zsolt Kohalmi, Global Head of Real Estate and Co-Chief Executive Officer at Pictet Asset Management

The expansion of the digital economy is fuelling demand for data centres, but also raising concerns about their energy use. The solution to this problem comes in the form of an attractive green real estate investment.

Every minute of every day, the world’s 4.6 billion Internet users spend $1 million online, send 41.7 million WhatsApp messages, make 1.4 million calls and upload 500 hours of video. With the rise of 5G technology, the daily volume of data will surely surge further.

That, in turn, will cause an equally powerful increase in demand for a specialist kind of real estate: the data centre.

Zsolt Kohalmi, Global Head of Real Estate and Co-Chief Executive Officer at Pictet Asset Management

In Europe alone, the data centre market is forecast to grow by USD71 billion over the period 2020-2024, representing a compound annual growth rate of (CAGR) of 15 per cent. This presents a unique investment opportunity for real estate investors looking for an asset class with strong fundamentals. Data centres offer relatively attractive yields ranging between 5-7 per cent for core, prime locations in Europe – and typically tend to have longer length inflation-linked leases, offering some protection against inflation.

But the opportunity comes at a cost. Processing and storing an enormous amount of data is highly energy intensive. By 2025, data centres may account for 20 per cent of the world’s energy use, and 5.5 percent of its carbon footprint according to Swedish researcher Anders Andrae.

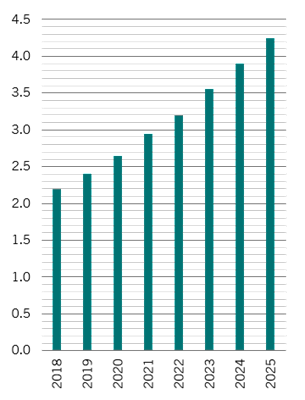

Nordic data centre investment volume (EUR bn)

Source: COWI

Fortunately, there is widespread acknowledgement that the sector needs to reduce its outsized environmental impact – from companies that own or run data centres, their shareholders, consumers and regulators. Achieving this requires a two-pronged approach.

The first step involves optimising data infrastructure. The technology that is housed in data centres can be made more efficient, for example through installing micro servers, or through using artificial intelligence to optimise server and energy utilisation.

The second step entails making the buildings greener. That’s where active real estate investors can get involved and, by extension, capitalise on a sustainable investment opportunity. As with all real estate, location is crucial. For data centres, it’s not so much about transport links or footfall, but more about the weather – cold climates help reduce the consumption of energy, much of which is usually spent on cooling down the machines. It’s no coincidence that data centre investment in the Nordics is forecast to nearly double between 2018 and 2025 (see chart). Crucially, the region is also well-equipped with super-fast fibre networks – the motorways of the digital world, which use cables made up of glass strands over which data is transferred in the form of optical light.

Then it’s on to the buildings. Having them run on renewable energy is key – even better if it is produced on site. Building insulation is also important, as is close monitoring of utilities consumption to ensure optimal power usage. New-built data centres boast some of the highest green credentials. But the very act of building from scratch is far from green – production of cement alone accounts for around 8 per cent of global carbon emissions. Principally, refurbishment and retrofitting will almost always remain better for the environment. The refurbishment route also provides the best potential for real estate returns through adding value.

Pictet’s recent acquisition in Akalla, on the outskirts of Stockholm is an example. Part of the building is already occupied by a data centre, and over time we intend to convert the majority of the remaining area, which is currently a printworks, into data centre space. Some solutions are low tech – such as adding new floor slabs, to optimise the space, thereby improving efficiency. Others are truly innovative. Data centres generate a lot of heat, which is normally emitted into to the environment. We are planning to capture and channel that heat into a district heating system that provides heat to residential units within the municipality. Additionally, we are evaluating the option of generating energy ‘on-site’ through solar, wind or other renewable means. Locally produced energy is undeniably more efficient to consume, compared to that which is transported across large distances through the power-grid, which suffers significant transmission losses.

Investing in green data centres is one way to tap into the robust growth of technology while fulfilling environmental objectives. As our lives become increasingly digital – accelerated by the pandemic and by the arrival of 5G – demand for data centres will continue to grow exponentially. We believe this area of commercial real estate will very quickly develop into a bond-like investment, providing a stable stream of returns for core and core-plus property portfolios.

However, for now, due to the speed of growth and lack of suitable premises, there is also an opportunity for real estate investors to generate additional return by re-purposing existing buildings. The challenge is to find assets with a sufficiently large floor space (such as large logistics centres), in a strategic location where dark fibre and electricity meet, and to take a creative, innovative approach to making the building as green and efficient as possible.

[1] Domo, "Data never sleeps 8.0"

[2] Infiniti Research, "Data center market in Europe"

[3] World Economic Forum

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

This marketing document is issued by Pictet Asset Management. It is neither directed to, nor intended for distribution or use by any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund’s prospectus, the KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet.

This document is used forinformational purposes only and does not constitute, on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund’s prospectus and are not intended to be reproduced in full in this document. Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund’s full documentation or for any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

EU countries: the relevant entity is Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg. Switzerland: the relevant entity is Pictet Asset Management SA , 60 Route des Acacias – 1211 Geneva 73. Hong Kong: this material has not been reviewed by the Securities and Futures Commission or any other regulatory authority. The issuer of this material is Pictet Asset Management (Hong Kong) Limited. Singapore: this material is issued by Pictet Asset Management (Singapore) Pte Ltd. This material is intended only for institutional and accredited investors and it has not been reviewed by the Monetary Authority of Singapore. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957)

is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001. For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in North America to promote the portfolio management services of Pictet.